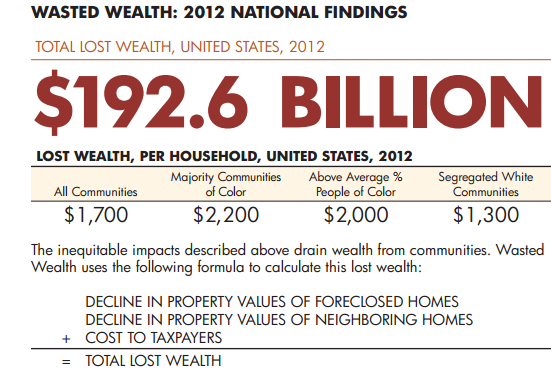

Struggling homeowners, people who are unemployed and underemployed, and other community leaders late last week delivered a new study to Georgia's Governor Nathan Deal revealing that Atlanta lost close to $1 billion in wealth due to the foreclosure crisis in 2012.

Of the approximately $902 million that the City of Atlanta lost in the housing crisis last year, the most devastating impacts were in communities of color where average lost wealth per household was $4,900 — more than two times the $2,300 average wealth lost in predominantly white zip codes, according to the report.

The landmark study, “Wasted Wealth: The Foreclosure Epidemic, a Generational Crisis for Communities of Color,” was released last week by Occupy Our Homes Atlanta along with the Alliance for a Just Society, Home Defenders League and The New Bottom Line. It analyzed 2012 foreclosure data to calculate lost wealth, examine the ongoing threat of foreclosures-in-waiting, and explore the economic impacts of principal reduction.

“While the impacts of the housing crisis have been felt broadly across communities and across the country, these data shows that there’s a clear racial dimension to the foreclosure crisis: households in communities of color are the hardest hit,” said report co-author Jill Reese, associate director of the Alliance for a Just Society.

The full report, including national numbers, data for all 50 states, and special breakouts for 19 cities, is available here.

“Seeing this loss of wealth per household is profound. People of color in Atlanta, whose majority equity holdings remain in real estate, have been particularly affected by the crisis,” said Joe Beasley with Rainbow Push Coalition. “Without principal reduction or other interventions, people of color in this city will continue to bear the brunt of this crisis.”

One citizen, Mark Harris, said of the foreclosure crisis: “The country cannot ignore the damage it has caused on my life, and the lives of homeowners in my community. The threat to my family and our safety, the threat of losing our home is unacceptable.”

In addition to the wealth already lost in communities like the one Harris belongs to, the report found there were at least 36,000 underwater mortgages still on the books in Atlanta in 2012, with another $600 million in wealth at stake if a share of these mortgages go into foreclosure.

Homeowners like Harris have worked with Occupy Our Homes Atlanta to push Congress and the Obama administration to deal with the current and pending crisis by enacting principal reduction.

Examining the economics of principal reduction, the report found that a principal write-down program could save underwater homeowners in Atlanta an average of $6,700 annually, generate a quarter of a million dollars in economic activity, and create 3,600 jobs.

“One of the strongest changes we could make as a nation is to implement principal reduction for homeowners,” said Tim Franzen of Occupy Our Homes. “We would stop the local bleeding and put $6,700 into the pockets of homeowners."

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments