The Economic Policy Institute, a Washington-based think tank, recently reported that CEO compensation at the 350 largest U.S. companies rose 17.6 percent in 2017 to an average of $18.9 million*, while pay for the average worker rose 0.3 percent. Adjusted for inflation, CEO pay is up 20 fold since 1965.

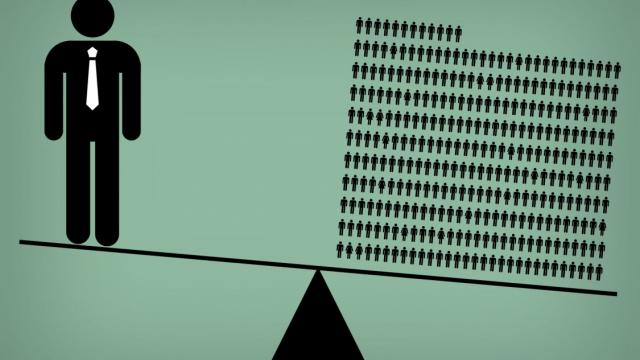

More important, CEO compensation at those companies averaged 312 times that of the average worker’s, up from 20 in 1965 and 270 in 2016. While the ratio is down from its 2000 peak of 344 (it was knocked back by the dotcom bust and the 2008 crash), it’s on the rise again, and the long-term trend is obvious: The rewards that capitalism bestows on elites, especially since the 1990s, are diverging sharply from what it bestows on workers. Other surveys produce similar results.

The people who should be angriest about this are capitalists themselves – the sort of folks who lecture the world about good corporate governance, executive “accountability” and “pay for performance,” to cite the usual buzzwords. Remember, after all, how defenders of “greed-is-good” justify extravagant CEO pay packets: They’re what attract the top-flight management needed to steer the corporate ship toward ever higher earnings.

This, in turn, enriches shareholders directly and society indirectly, by fueling economic growth and producing higher incomes for everyone. A central concept here is “CEO-shareholder alignment,” meaning that if management is adequately incentivized, everyone benefits.

That’s what they promise; here’s what you get: surging CEO pay that is not accompanied by surging profits, comparable increases in share prices or a significant rise in worker income. Using the same EPI measures as above, CEO pay rose an inflation-adjusted 1,070 percent in the 40 years through 2017, compared with 11.2 percent for a typical worker. The increase was 61 percent greater than stock-market growth over the period.

This record is not a good advertisement for American capitalism. Sincere capitalists lament what’s known as “rent seeking” – what happens when the well-connected pull strings to get via favoritism what they would not get in a competitive, transparent market, and without creating value. The mechanism driving the CEO pay racket is a recursive, self-referential process in which compliant corporate boards approve extravagant rewards by matching the excessive packages that other companies are paying. When everyone plays this game, you get a ratchet effect that raises CEO compensation without regard to actual performance, while funneling the fruits of capitalism from labor to management.

In addition, there is a whole industry of “executive compensation consultants” who get paid to devise clever ways to compensate top management, often at the expense of shareholders and labor. These include things like “reloading” of stock options, the financial equivalent of playing tennis without a net.

And we haven’t even touched yet on the issue of “golden parachutes,”, the extravagant boodle even mediocre CEOs are paid just to walk away.

As EPI puts it, CEO compensation growth reflects not just the increased value of management skill but “substantial economic rents” and “the power of CEOs to extract concessions.” And these are the sort of people who you just know applauded Mitt Romney’s sneering dismissal of “takers.”

To be sure, there are those who argue that the CEO pay ratio is just a gratuitous way of shaming corporations and will do little to boost worker pay. What’s more, they say, the cost of complying with the regulatory rule requiring disclosure of CEO pay ratios leaves less for investing in employees.

But where is the evidence that companies would otherwise pass these savings to workers? A 2014 Harvard study shows that from 2003 to 2012, S&P 500 companies spent 54 percent of their earnings on share buybacks and 37 percent on dividends. That didn’t leave much for employee pay raises.

Part of what we’re seeing here is a business culture that over several decades has abandoned what economist William Lazonick calls a “retain-and-invest” approach to running companies: Traditionally, he says, companies “retained earnings and reinvested them in increasing their capabilities, first and foremost in the employees who helped make firms more competitive. They provided workers with higher incomes and greater job security, thus contributing to equitable, stable economic growth—what I call ‘sustainable prosperity.’”

But, says Mr. Lazonick, the ethos of value creation gave way in the 1970s to one of value extraction, which emphasized downsizing to cut costs and distributing the savings more to shareholders than to workers, who became little more than overhead to be trimmed at every opportunity. Open-market stock buybacks, unleashed by a Reagan-era regulatory change, have also tended to short-shrift workers.

CEO excess is to some extent a uniquely American problem. As this Bloomberg story shows, it far exceeds that of other major economies. CEOs and pay consultants say they are so richly compensated because that’s what the so-called market for talent requires. But what happened to the global, borderless economy that they routinely cite as the reason for stagnant U.S. wage growth? How is it that the global market for talent suppresses workers’ wages but not CEOs’?

Well, one might ask, don’t companies exist for the benefit of their shareholders, which are always foremost in CEOs' minds, and aren’t workers also shareholders through their 401(k)s and IRAs?

Some are, but many are not, and not entirely because they simply neglect to participate. According to a 2017 Pew survey, only 65 percent of private-sector employees age 22 and over work for firms that offer such plans, and of course their contributions are constrained by what they earn. (The average 401(k) balance managed by Vanguard, one of the largest plan administrators, was $104,000 last year. Only 13 percent of Vanguard participants maximize the legally allowable contribution.) Workers without a 401(k) can establish an IRA, but the same income constraints apply here, too, and the maximum allowable contribution is only $5,500 a year if you’re under 50.

It’s beyond obvious, then, that the benefits of shareholding favor elites far more than average folks, whose welfare is already diminished by things like the decades-long weakening of union power, the shifting of pension risk from employers to employees, and the political refusal to establish universal health coverage.

Dismay over excessive CEO pay is not, as many on the right are quick to object, a matter of class war and petulant envy. EPI notes that “the growth of CEO and executive compensation overall was a major factor driving the doubling of the income shares of the top 1 percent and top 0.1 percent of U.S. households from 1979 to 2007.”

This matters because, as wealth shifts increasingly to a smaller coterie of elites, inequality grows. And as economic disparities widen, so do disparities in political influence, challenging the most elemental assumptions of democracy. In an era when money is deemed political speech, wealthy minorities necessarily have louder voices than everyone else, and those voices tend to promote policies that generate further inequality. The vicious cycle here should be obvious.

Lenin supposedly justified the harshness of Bolshevism with the phrase, “You have to break some eggs to make an omelet.” To which Orwell famously responded, “Where’s the omelet?”

One could ask a similar question of U.S.-style capitalism, where the reward for chronic insecurity and inevitable inequality is supposed to be a rising tide that lifts all boats. OK, so where’s the tide?

*The figure includes realized stock options, as opposed to those that have been granted but not yet exercised.

The author is a veteran of financial journalism who writes from New York. Follow him @cgayNYC