If foxes are put in charge of rebuilding a chicken coop, it is a given that the chicken’s new quarters will be less than secure. In terms of rebuilding the economy, with the predatory interests of Wall Street dictating the "solutions" proposed by both the Republicans and Democrats, it is a given that their plans will leave workers vulnerable so that big business’s profit-driven appetite can gorge itself.

By endorsing Obama and the Democrats, Labor’s leadership has abandoned its opportunity to promote a different blueprint for the economy that would put workers’ interests first in this political season. It’s hard to fight against the foxes when you are campaigning for their candidates.

As a result, workers’ voices have been politically gagged for the moment. Consequently, those left to devise a way out of the economic crisis are bound to come up with, to considerably understate the matter, peculiar remedies. Enter, as an example, the Federal Reserve’s "Quantitative Easing" (QE) scheme.

The plan outlined by Federal Reserve’s Chairman Ben Bernanke will create money ex nihilo ("out of nothing") for the purpose of buying mortgage-backed securities in the jaw-dropping amount of $40 billion a month for an unlimited duration. He also signaled the Fed’s willingness to keep interest rates ultra-low until at least mid-2015 in order to encourage businesses to borrow money and expand their operations.

The justification for these measures is that by pumping massive amounts of money into the banks, while keeping interest rates low, banks will be more willing to make loans to the private sector, thereby encouraging economic growth and job creation.

There are a couple of problems with this rationale, however.

One is that the businesses are already hoarding trillions of dollars rather than expanding their operations. They are not being stingy. They are in business to make a profit, and if the vast majority of Americans do not have the money to buy goods and services from them, there is no profit to be realized. So banks offering to lend businesses money at low rates will accomplish little to nothing.

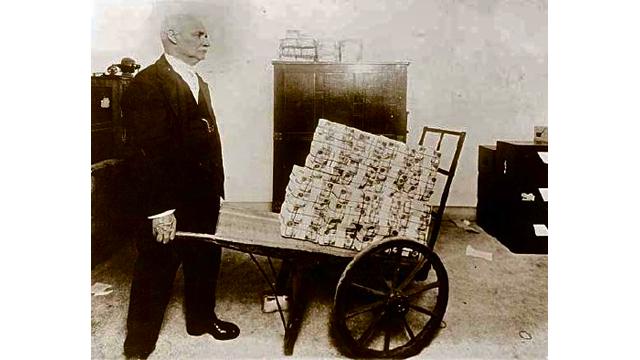

Another problem is that QE will encourage inflation. To a large degree, this is the intended outcome. It is hoped that corporations will be encouraged to expand by seeing higher future sales; U.S. exports will be more competitive, since the dollar will be worth less in relation to other currencies; and home buyers will find it easier to repay their debt because the money that they have borrowed will be worth less.

Unfortunately, most workers’ income is already being decimated by the rising cost of health care, food, gas and other basic needs. Increasing inflation will only make the fundamental problem worse because wages generally do not keep up with inflation so workers will not be able to buy as many goods and services as before. You can’t expand production for profit while the vast majority of consumers’ ability to buy is being tightened.

QE is not a new invention by Bernanke. It has been used before with dubious results. For instance, Japan tried it to deal with their economic stagnation in 2001. In an article by Financial Times writer John Richards titled "Quantitative easing: Lessons from Japan," Richards wrote:

"The process ignited a bond bubble whose eventual collapse destabilized financial markets, even threatening Japan’s hard-earned economic recovery."

He later said: "The costs were the shutting down of the money market, although it revived fairly quickly when QE ended, and a dangerous bond-bubble, whose popping threatened the recovery and destabilized the financial system."

QE has also been tried in England and in the U.S. in 2009 as well. The positive results in terms of strengthening the nations’ overall economy are debatable even among these measures’ supporters. One outcome is certain: the Federal Reserve’s QE will greatly contribute to the already historic level of inequality that exists in the U.S. and distort the economic and political systems in favor of the ultra-wealthy.

This is because QE drives up the prices of financial assets, and the top 5 percent own 60 percent of the U.S.’s individually held assets. Also, with QE’s focus on mortgage banks it will mean low rate loans will be available to those who are better off, while doing absolutely nothing for those who cannot afford to buy houses.

It is no wonder why stocks soared after Bernanke’s announcement and Donald Trump was moved to say: "People like me will benefit from this." In the words of Rolling Stone economic writer Matt Taibbi, QE is a hidden government subsidy for the banks.

The climbing stock market will help Obama’s re-election campaign because of the illusion of growing economic health. However, these results will not "trickle down."

This is not because of any mistake on the part of the policy makers. Both the Republican and Democratic parties are in competition to demonstrate their ability to deliver the goods to their Wall Street funders who are guided by the view that the rich aren’t rich enough, even if that means everyone else will be poorer. High unemployment and low wages are the new normal desired by these deep-pocketed sorts because that helps their profits. The corporate party’s politicians are working hand in hand with them so that they can realize their goals.

This pernicious marriage between the political and economic elites could not be better demonstrated than by how the Federal Reserve will be buying financial instruments in Bernanke’s QE plan. Matt Taibbi writes:

QE is designed to buy Treasuries and other assets, but the Fed does not simply go out and buy Treasuries itself; it does it through its primary dealers, who include of course banks like Goldman Sachs. The Fed announces when it’s going to be doing this buying and in what quantity, which allows the banks to buy this stuff at lower prices ahead of time and then sell it to the Fed at inflated cost.

If such steps were taken between stock companies on Wall Street, it would amount to insider trading. Since it is the government making the arrangements with the banks, it is called a bold action to strengthen the economy.

QE is bad news for workers. Rather than taxing big business to build a federal jobs program that will increase employment, put more money into the real economy, and raise the vast majorities’ living standards, the politicians are again giving the banks a bail out with another name.

Both union and unorganized workers need to unite around our shared interests in opposition to the architects of QE and those it is designed to benefit. A mass independent social movement is required to rebuild the economy and keep the foxes out.

Mark Vorpahl is a union steward, social justice activist and writer for Workers Action.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments