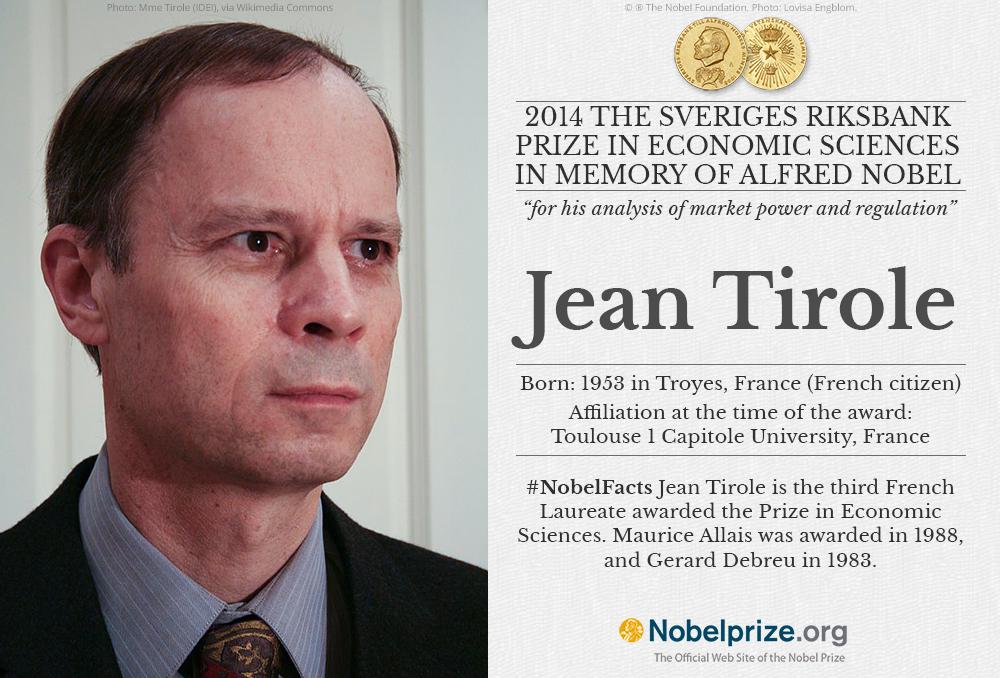

Jean Tirole – the French economist who has used game theory in an attempt to find ways to control the dominance of major companies – has won the Nobel prize for economics.

Tirole, of the University of Toulouse, said he was very grateful for the award for his work on “taming powerful firms.”

The committee, which awarded the Sveriges Riksbank prize in economic sciences in memory of Alfred Nobel, selected an area of economics that has become increasingly important, as governments have privatized former public monopolies, like water, electricity and telecoms.

“This year’s prize in economic sciences is about taming powerful firms,” Staffan Normark, permanent secretary of the Royal Swedish Academy of Sciences, said as he named Tirole the winner of the 8m kroner (£700,000) prize.

Tirole, 61, began his work on regulation and oligopolies in the 1980s and published an influential book in 1993 with the late Jean-Jacques Laffont on regulation. The judges said Tirole is “one of the most influential economists of our time.”

They added: “He has made important theoretical research contributions in a number of areas, but most of all he has clarified how to understand and regulate industries with a few powerful firms.”

The panel said Tirole had shown the “deep and essential differences” between regulating companies in different sectors, such as telecom companies or banks.

Imposing caps on prices could reduce the influence of monopolies in some sectors, but not in others, the judges said, pointing to Tirole’s use of game theory and contract theory.

In a paper last year, Tirole scrutinized, with Roland Bénabou, the pay and motivation structure in industries such as banking. They write about a “bonus culture that takes over the workplace, generating distorted decisions and significant efficiency losses, particularly in the long run.”

As he was awarded the economics prize – the first without an American winner or joint winner since 1999 – Tirole was asked how his theories could be used to keep companies such as Google in check. His response was that while some industries had a tendency to become monopolies this was not a problem as long as they could be replaced by new firms.

“You need to have possible entry … so that more dynamic firms can replace incumbent firms,” he said.

The award, first handed out in 1969 by the Swedish central bank at the same time as the other awards handed out in memory of Alfred Nobel, has been won by 74 individuals, some of whom have become familiar names such as Joseph Stiglitz – with whom Tirole has worked in the past – James Tobin and Milton Freedman. Only one woman has ever won, Elinor Ostrom in 2009.

Last year, the prize when to three economists Eugene Fama, Lars Hansen and Robert Shiller for their work in predictions in financial markets.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments