According to a report from the Federal Reserve, over the last two decades the nation’s biggest banks have created thousands of subsidiaries for the purpose of dodging taxes and regulation. As Bloomberg News reported, the most prolific user of these subsidiaries is JP Morgan Chase:

•"The biggest U.S. banks created more than 10,000 subsidiaries in the past 22 years as they expanded, using legal structures to pay lower taxes and escape tighter regulation, according to a Federal Reserve study.

•"JPMorgan Chase, the largest U.S. lender, has the most units at 3,391, followed by Goldman Sachs, Morgan Stanley and Bank of America with more than 2,000 each, the study by the Federal Reserve Bank of New York shows. Citigroup, the third-largest lender, has 1,645.

•"The subsidiaries in the Fed study include the banks’ overseas units. For Morgan Stanley, Goldman Sachs and New York-based Citigroup, about half the legal entities are based outside the U.S. At JPMorgan and Bank of America, the ratio drops to below a quarter."

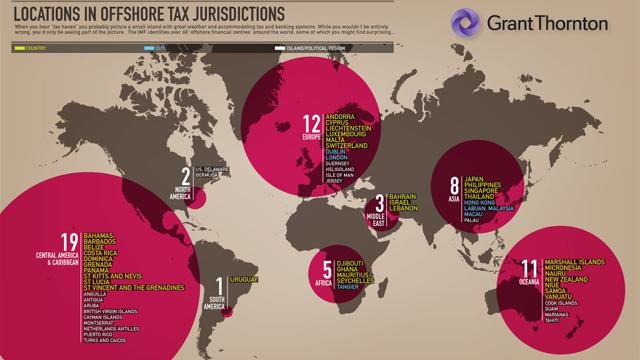

The use of corporate tax havens costs the U.S. government about $60 billion annually. In order to make up for that lost revenue, the U.S. would have to charge every one of the nation’s small businesses $2,116.

It’s likely no coincidence that the banks most focused on investment banking had more subsidiaries than commercial banks, as they’re more likely to want to help their clients shift money around to low- or no-tax jurisdictions. And as a new study from the Tax Justice Network showed, there’s at least $21 trillion in wealth held in tax havens by the world’s wealthy. Having thousands of subsidiaries surely helps the biggest banks facilitate such activity.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments