The European Central Bank (ECB) announced this week how it will undertake a root-and-branch examination of banking assets before it takes charge of supervision in the euro area late next year (see article). One aim of the exercise is to identify the bad debts that are fouling up euro-zone banks and preventing the flow of new credit. This is important because parts of the single-currency area are crippled not just by public borrowing but by private debt, most of which is sitting on banking books.

Throughout the euro crisis, tough austerity programs have been aimed at tackling sovereign debt. That German-inspired focus is badly misplaced. High private debt is more detrimental to growth than high public debt, according to recent research by the IMF. Indeed the IMF study finds that excessive sovereign debt reduces growth only when household and corporate sectors are heavily indebted too.

The malign effect of high private debt becomes apparent in the busts that follow credit-driven booms. Households that have borrowed too much in relation to their income trim their spending, the main component of GDP. Over-leveraged firms avoid investing and concentrate on shrinking their balance-sheets by paying off loans. As bad debts erode their capital, banks become more reluctant to lend. These adverse trends reinforce each other, increasing the overall drag on growth.

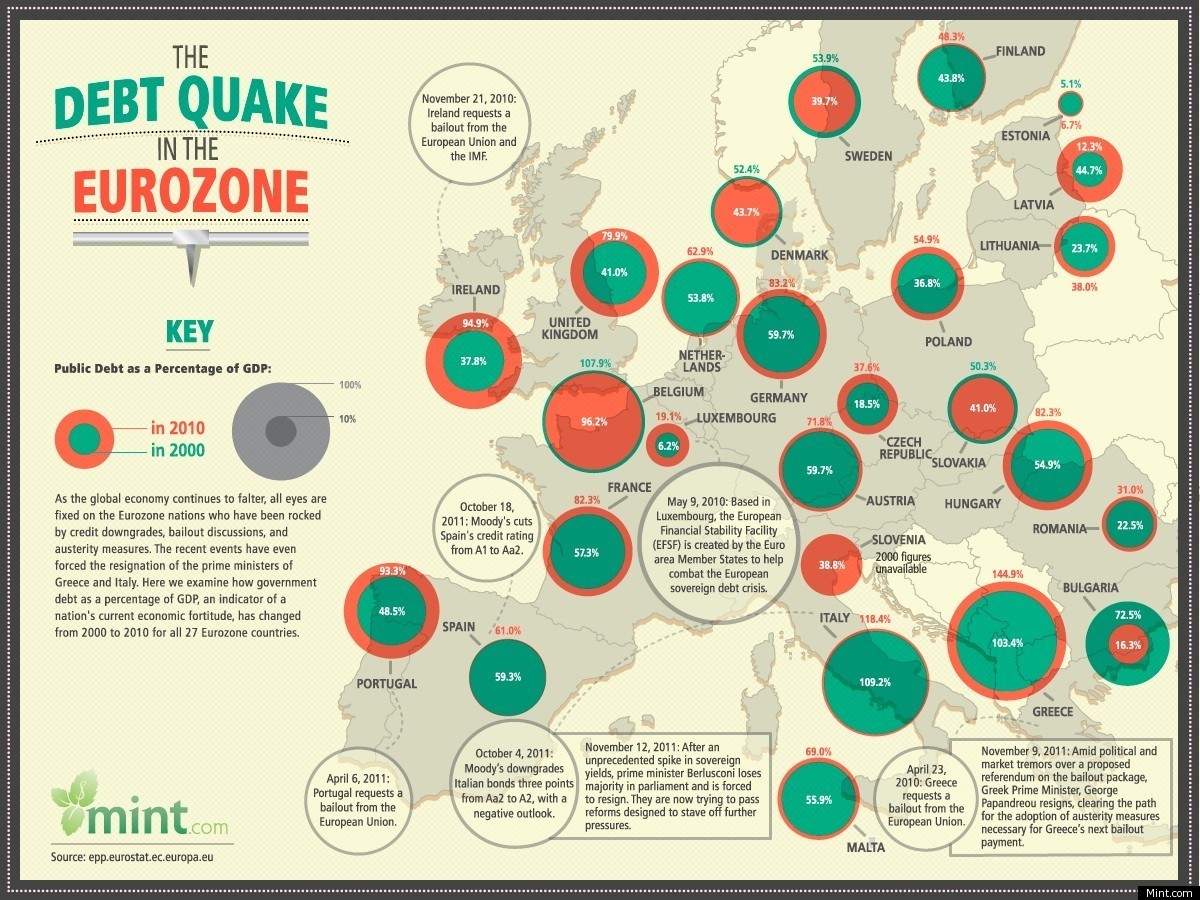

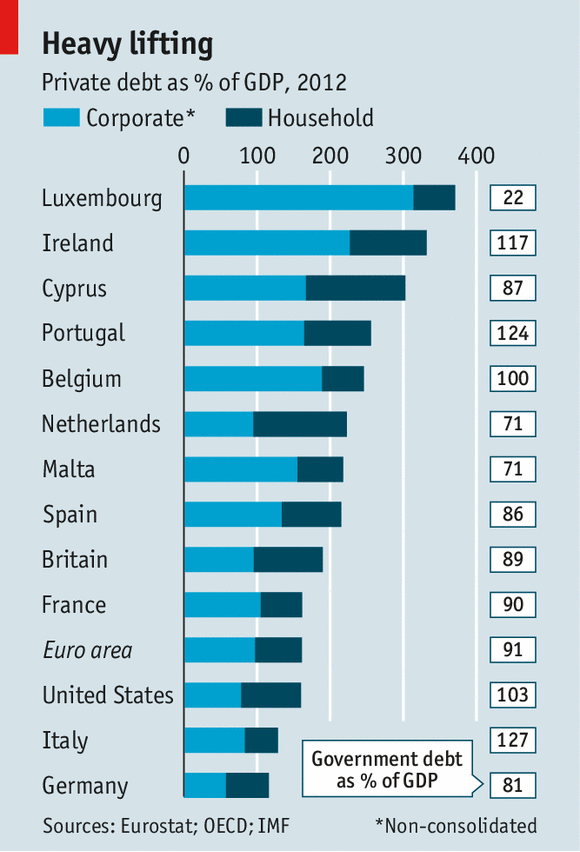

Figuring out the point at which debt becomes excessive is not an exact science. The European Commission, which now has the job of monitoring any emerging macroeconomic imbalances, uses a figure of 160% of GDP for private debt—what households and non-financial companies owe in the form of loans and debt securities such as corporate bonds. That looks conservative: it happens to be the prevailing level in both America and the euro area as a whole.

A more realistic trigger for concern might be 200% of GDP. On this basis, eight countries of the 17 that share a common currency look vulnerable.

Of the eight, Belgium and Luxembourg are less worrying than they might appear because their corporate debt is swollen by the presence of multinationals and includes a big chunk of inter-company lending. But that does not apply to the Netherlands, where private debt is over 220% of GDP mainly because households owe so much. In tiny Malta it is nearly 220%. Private debt is also high in four countries that have had to be bailed out: in Cyprus and Ireland it is over 300% of GDP; in Portugal it is 255%; and in Spain 215%.

In all but one of the eight countries a majority of the private debt is corporate. This preponderance of company borrowing is most extreme in Luxembourg, but also notable in Ireland whose debt is also affected by the presence of multinational firms; even so, Ireland’s household debt alone is over 100% of GDP. The Netherlands is the only country where the majority of debt is personal: its household debt is 128% of GDP (though Cyprus’s is even higher, at 136% of GDP).

Although Italy has the second-highest sovereign debt in the euro area, it does not feature among the countries with excessive private debt. Its firms owe somewhat less than the euro-zone average and Italian household debt is especially low. But monitoring the ratio of debt to GDP is not the only measure of vulnerability. For non-financial companies, an important indicator of fragility is a high ratio of debt to equity; and on this measure Italian firms, especially the small and medium-sized ones, are particularly stressed.

Other balance-sheet indicators also suggest that Italian business is in a bad way. For example, 30% of corporate debt is owed by firms whose pre-tax earnings are less than the interest payments they have to make. That share of frail companies is even higher in Spain and Portugal (40% and nearly 50% respectively). But Italy’s plight is in stark contrast to the situation in France and Germany, where little more than 10% of corporate debt is owed by such weak performers. Italian firms have been hurt by the erosion of their competitiveness within the euro zone.

Little progress has been made to lighten the private-debt burden since the crisis began. Though it eased in Spain from 227% of GDP in 2009 to 215% in 2012, it rose over the same period in Cyprus, Ireland and Portugal. In Britain, by contrast, private debt fell from 207% of GDP in 2009 to 190% in 2012 thanks to improvements by both households and firms.

Getting debt down has proved intractable because the economic climate has been so unforgiving. Debt burdens (i.e., debt as a share of GDP) automatically become lighter as money incomes rise. But that has not been the case in economies hit by a double-dip recession and hurt by prices that are close to deflationary levels. There is an inherent contradiction between the need for debtor countries in the euro zone to regain competitiveness through lower prices and at the same time to ease excessive debt with a dose of inflation.

Even in a better economic climate, though, southern Europe would be bad at writing down debt. Corporate insolvencies have increased sharply but from low levels. Social attitudes frown on debtors, who are usually pursued through the courts in a long and costly process.

Insolvency laws have recently been reformed in several countries. The Portuguese government, for example, has made it easier for debt to be restructured outside the courts. But the reforms often fail to work. The Spanish law is intended to promote restructuring of viable firms but in practice most insolvencies end in liquidation after lengthy court proceedings. The cultural stigma of a bankruptcy remains: potential entrepreneurs in countries like Italy and Spain worry more about failure than they do in Britain and America.

Dutch Discouraged

High household debt helps explain why the Netherlands, along with Italy and Spain, remained in recession in the second quarter of 2013 even as the euro area in general embarked on recovery. Dutch GDP this year will be 2% lower than in 2011 and more than 3% below its previous peak, in 2008. Though this loss of output is dwarfed by that suffered in southern Europe, it illustrates the malign effect of high debt when house prices fall—recent declines have been close to those in Spain. That has pushed a quarter of Dutch homeowners into “negative equity”: their houses are worth less than their mortgages.

Elsewhere in the euro area high corporate debt has been doing most damage. Firms that have over-borrowed are reluctant to embark on new ventures, and banks are in any case reluctant to lend because their balance-sheets are peppered with bad debts. This unhappy state of affairs prevails throughout southern Europe though its precise causes vary. In Spain the bad debts have arisen mainly from the property bubble and have been tackled over the past year by recognizing the losses and transferring the written-down loans to Sareb, an asset-management company. In Portugal they stem from the attrition of more than a decade of stagnation.

The ECB’s banking probe will cause some of this debt to be written down as banks are forced to recognise some of their bad loans. But the clean-up could be limited because of the fear among the European countries with solid finances that bad banking debts will be dumped into a common rescue fund. If the quality of these assets is not properly addressed this time, it will cast a long shadow over the euro zone’s chances of making a sustained economic recovery.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments