Threatening a climate-stable planet, the world's biggest banks are continuing business-as-usual by continuing to provide funding for "extreme fossil fuels."

So finds the latest Fossil Fuel Finance Report Card—produced by Rainforest Action Network, BankTrack, Sierra Club, and Oil Change International—which defines the "extreme" sources as tar sands, Arctic oil, ultra-deepwater oil, coal mining, coal power, and liquefied natural gas (LNG) exports.

As RAN said in an email to supporters: "To keep the planet under 1.5 degrees of global warming and stop human rights violations, banks must stop financing extreme fossil fuels. Our planet just can't take it."

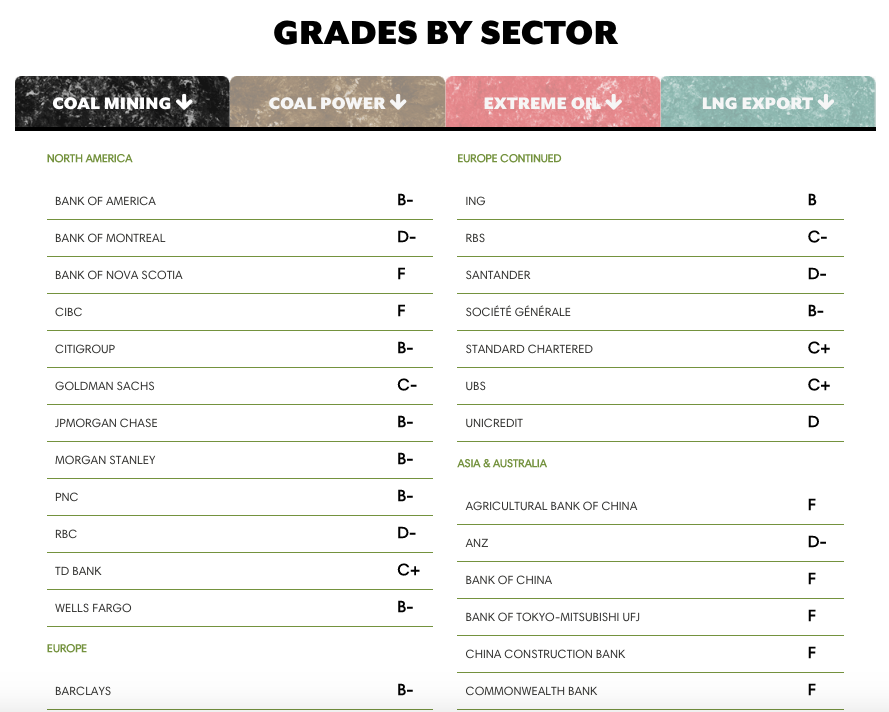

The "Banking on Climate Change" report—released in collaboration with over two dozen organizations including Bold Alliance, SumOfUs, West Coast Environmental Law, and Indigenous Climate Action—looks at 37 major banks' lending and underwriting transactions, and gives them A-through-F grade based on their policies. It also gives a brief look at banks' human rights failures.

Despite its worrying findings, there is a bit of good news the report. From 2015 to 2016, the analysis found, the amount the banks poured into extreme fossil fuels dropped 22 percent, from $111 billion down to $87 billion. But the report cautions that for the sake of the planet, this must not be "just a temporary decline."

Further qualifying the good news, the report adds:

"The $290 billion of direct and indirect financing for extreme fossil fuels over the last three years represents new investment in the exact subsectors whose expansion is most at odds with reaching climate targets, respecting human rights, and preserving ecosystems."

Another startling finding noted by the report:

"12 of the 37 banks increased their financing to the top extreme fossil fuel companies from 2015 to 2016, after the Paris Agreement was inked: Australia and New Zealand Banking Group (ANZ), Bank of America, Bank of Montreal, Barclays, China Construction Bank, Citigroup, JPMorgan Chase, Mizuho Financial Group, Santander, Toronto-Dominion Bank (TD), UBS, and UniCredit."

A case study laid out in the report is TransCanada's 1,179-mile Keystone XL pipeline (KXL), which would bring tar sands crude from the Canadian province of Alberta to Nebraska and link to an existing network of pipelines. While the pipeline is back, the report says, "so is the people power that fought to stop it the first time."

And given "the heated criticism banks received for financing the Dakota Access Pipeline (DAPL), any banks associated with KXL or TransCanada face even greater reputational risk than before." The report goes on:

It is yet to be determined whether TransCanada will seek project-specific financing to construct KXL. In the absence of direct project finance, it is the 21 banks on TransCanada's revolving credit facilities that are, effectively, the funders of Keystone XL. Of the banks analyzed in this report, Bank of America, Bank of Montreal, Barclays, Canadian and Imperial Bank of Commerce (CIBC), Citi, Crédit Agricole, Credit Suisse, Deutsche Bank, HSBC, JPMorgan Chase, Mitsubishi UFJ Financial Group (MUFG), Mizuho, RBC, Scotiabank, SMFG, TD, and Wells Fargo all participate in multi-billion dollar lines of credit to TransCanada.

JP Morgan Chase earned the dubious distinction of being the biggest Wall Street funder of extreme fossil fuels.

"In 2016 alone they poured $6.9 billion into the dirtiest fossil fuels on the planet," said Lindsey Allen, RAN's executive director. "On Wall Street they are number one in tar sands oil, Arctic oil, ultra-deepwater oil, coal power, and LNG export. Even in this bellwether year when overall funding has declined, Chase is funneling more and more cash into extreme fossil fuels. For a company that issues statements in favor of the Paris Climate Accord, they are failing to meet their publicly stated ambitions."

The report comes amid increasing calls to "keep it in the ground," alongside new state- and city-led efforts to move forward on climate action, and amid growing evidence that fossil fuel investments make poor economic sense.

"There's no question that funding climate change is a deadly investment strategy," stated Jenny Marienau, 350.org's U.S. campaigns director. "Yet banks around the world are funneling billions of dollars into the fossil fuel projects leading us closer to catastrophic warming every day."

"Movements like the Indigenous-led effort to Defund DAPL are rightfully pressuring banks to divest from infrastructure like the Dakota Access pipeline that puts profits before human rights and a livable future," Marienau said. "It's up to us to resist these disastrous projects, push back on these fatal investments, and build the renewable energy solutions we need."

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments