This is the second in a two-part article on the debt burden America’s students face. Read Part I here.

The lending business is heavily stacked against student borrowers. Bigger players can borrow for almost nothing, and if their investments don’t work out, they can put their corporate shells through bankruptcy and walk away. Not so with students. Their loan rates are high and if they cannot pay, their debts are not normally dischargeable in bankruptcy. Rather, the debts compound and can dog them for life, compromising not only their own futures but the economy itself.

“Students should not be asked to pay more on their debt than they can afford,” said Donald Trump on the presidential campaign trail in October 2016. “And the debt should not be an albatross around their necks for the rest of their lives.” But as Matt Taibbi points out in a December 15 article, a number of proposed federal changes will make it harder, not easier, for students to escape their debts, including wiping out some existing income-based repayment plans, harsher terms for graduate student loans, ending a program to cancel the debt of students defrauded by ripoff diploma mills, and strengthening “loan rehabilitation” – the recycling of defaulted loans into new, much larger loans on which the borrower usually winds up paying only interest and never touching the principal.

The agents arranging these loans can get fat commissions of up to 16 percent, an example of the perverse incentives created in the lucrative student loan market. Servicers often profit more when borrowers default than when they pay smaller amounts over a longer time, so they have an incentive to encourage delinquencies, pushing students into default rather than rescheduling their loans. It has been estimated that the government spends $38 for every $1 it recovers from defaulted debt. The other $37 goes to the debt collectors.

The securitization of student debt has compounded these problems. Like mortgages, student loans have been pooled and packaged into new financial products that are sold as student loan asset-backed securities (SLABS). Although a 2010 bill largely eliminated private banks and lenders from the federal student loan business, the “student loan industrial complex” has created a $200 billion market that allows banks to cash in on student loans without issuing them. About 80 percent of SLABS are government-guaranteed. Banks can sell, trade or bet on these securities, just as they did with mortgage-backed securities; and they create the same sort of twisted incentives for loan servicing that occurred with mortgages.

According to the Consumer Financial Protection Bureau (CFPB), virtually all borrowers with federal student loans are currently eligible to make monthly payments indexed to their earnings. That means there should be no defaults among student borrowers. Yet one in four borrowers is now in default or struggling to stay current. Why? Student borrowers are reporting widespread mishandling of accounts, unexplained exorbitant fees, and outright deception as they are bullied into default, tactics similar to those that homeowners faced in the foreclosure crisis. The reports reveal a repeat of the abuses of the foreclosure fraud era: many borrowers are unable to obtain basic information about their accounts, are frequently misled, are surprised with unexpected late fees, and often are pushed into default. Servicers lose paperwork or misapply payments. When errors arise, borrowers find it difficult to have them corrected.

Abuses and fraud in handling student loans have brought the Education Department’s loan contractors under fire. In January 2017, the Consumer Financial Protection Bureau sued Navient, one of the largest contractors, alleging that the company “systematically and illegally [failed] borrowers at every stage of [student loan] repayment.”

Getting a Fair Deal

The federal government could relieve these debt burdens, given the political will. A stated goal of the changes being proposed by the Trump Administration is to simplify the rules. The simplest solution to the student debt crisis is to make tuition free for qualified applicants at public colleges and universities, as it is in many European countries and was in some US states until the 1970s. If the federal government has the money to lend to students, it has the money to spend on their tuition (capped to curb tuition hikes). It would not only save on defaults and collections but could turn a profit on the investment, as demonstrated by the seven-fold return from the G.I. Bill. (See part 1 of this article.)

Alternatively, the government could fund tuition costs and debtor relief with a form of “QE for the people.” Instead of buying mortgage-backed securities, as in QE1, the Fed could buy SLABS and return the interest to students, making the loans effectively interest-free (as were the $16+ trillion in loans made to the largest banks after the 2008 crisis). QE that targeted the real economy could address many other budget issues as well, including the infrastructure crisis and the federal debt crisis; and this could be done without triggering hyperinflation. See my earlier articles here, here and here.

Needless to say, however, the government is not moving in that direction. While waiting for the government to act, there are things students can do; but first they need to learn their rights. According to a new surveyreported in November 2017, students are often in the dark about key details of their student loan debt and the repayment options available to them. To get started, see here and here.

Under the Borrower’s Defense to Repayment program, you can get your loans completely discharged if you can prove they were based on deception or fraud. That is one of the alternatives the Administration wants to take away, so haste is advised; but even if it is taken away, fraud remains legal grounds for contract rescission. A class action for treble damages against offending institutions could provide significant financial relief.

Students also have greater bankruptcy options than they know. While current bankruptcy law exempts education loans and obligations from eligibility for discharge, an exception is made for “undue hardship.” The test normally used is that paying the loan will prevent the borrower from sustaining a minimum standard of living, his financial situation is unlikely to change in the future, and he has made a good faith effort to pay his loans. According to a 2011 study, at least 40 percent of borrowers who included their student loans in their bankruptcy filings got some or all of their student debt discharged. But because they think there is no chance, they rarely try. Only about 0.1 percent of consumers with student loans attempted to include them in their bankruptcy proceedings. (Getting a knowledgeable attorney is advised.)

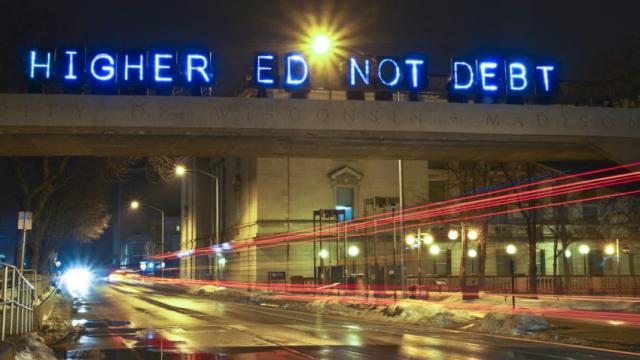

For relief as a class, students need to get the attention of legislators, which means getting organized. Along with degree mill fraud and contract fraud, a cause of action ripe for a class action is the student exclusion from bankruptcy protection, a blatant violation of the “equal protection” clause of the Fourteenth Amendment. If enough students filed for bankruptcy under the “undue hardship” exception, just the administrative burden might motivate legislators to change the law.

States to the Rescue?

If the federal government won’t act and individual action seems too daunting, however, there is a third possibility for relief – state-owned banks that cut out private middlemen and recycle local money for local purposes at substantially reduced rates. The country’s sole model at the moment is the Bank of North Dakota, but other states now have strong public banking movements that could mimic it. A November 2014 article in the Wall Street Journal reported that the BND was more profitable even than J.P. Morgan Chase and Goldman Sachs. The profits are used to improve education and public services.

According to its 2016 annual report, the BND’s second largest loan category after business loans is for education, with nearly a third of its portfolio going to student loans. As of December 2017, the BND’s student loan rates were 2.82% variable and 4.78% fixed, or about 2% below the federal rate (which ranged from 4.45% to 7% depending on the type of loan), and about 5% below the private rate (currently averaging 9.66% fixed and 7.81% variable interest). The BND also acts as the servicer of these loans, bypassing the third-party servicers abusing the system in other states.

In 2014, the BND launched its DEAL One Loan program, which offered North Dakota residents a unique option to refinance all student loans, including federal, into one loan with a lower interest rate and without fees. DEAL loans are fully guaranteed by the North Dakota Guaranteed Student Loan Program, which is administered by the BND.

The BND also makes 20-year school construction loans available at a very modest 2% interest. Compare that to the Capital Appreciation Bonds through which many California schools have been forced to borrow to build needed infrastructure, on which they have wound up owing as much as 15 times principal.

The BND’s loan programs have helped keep North Dakota’s student default rates and overall student indebtedness low. As of January 2017, the state had the second lowest student default rate in the country and was near the bottom of the list in student indebtedness, ranking 44th. Compare that to its sister state South Dakota, which ranked number one in student indebtedness.

The public banking movement is now gaining ground in cities and states across the country. A number of cities have passed resolutions to pull their money out of Wall Street banks that practice fraud as a business model. In New Jersey, Governor-elect Phil Murphy has made a state-owned bank the funding basis of his platform, with student loans one of three sectors he intends to focus on. If that succeeds, other states can be expected to follow suit.

We need to free our students from the system of debt slavery that has financialized education, turning it from an investment in human capital into a tool for exploiting the young for the benefit of private investors. State-owned banks can make the loan process fair, equitable and affordable; but their creation will be fought by big bank lobbyists. An organized student movement could be an effective counter-lobby. Historically, debt and austerity have been used as control mechanisms for subduing the people. It is time for the people to unite and take back their power.

Originally published by Truthdig

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments