Shell's controversial presence in the Arctic, U.S. shale lands and the Niger delta is in doubt after the oil group announced a sweeping strategic overhaul that includes the suspension of its Alaskan drilling program.

Taking the knife to some of his predecessor's pet projects, new chief executive Ben van Beurden said that the Anglo-Dutch company might have gone "too quickly" into shale exploration in the US and signaled a partial or total retreat from its onshore operations in Nigeria.

Van Beurden's plans, including a multi-billion-pound program of disposals and writedowns, were announced in the wake of a tumultuous fourth quarter that saw earnings plunge 71% to $2.1 billion while oil and gas production fell 5%.

"We have not always made the right capital choices," van Beurden said at a briefing in London as he revealed a $687m writeoff in North America from shale, gas and the damaged Arctic drilling rig Kulluk.

He blamed poor markets as well as internal failures for its problems as he dramatically pulled the plug on Shell's controversial scheduled drilling program in the Alaskan Arctic this summer.

Van Beurden admitted the exploration drive in the Chukchi and Beaufort seas, which has cost $5 billion so far, was "under review" amid a torrent of negative campaigning from green groups.

A swath of onshore shale oil and gas assets in North America, with a balance-sheet value of $24 billion, are also being considered for disposal or writedowns, while $1 billion has been knocked off U.S. shale drilling planned for this year. "You could argue we went in too far, too quickly [into shale]," he said.

Van Beurden also made clear that Nigeria, once a key part of the Shell empire but a country where onshore operations have been subjected to repeated physical attacks, was being prepared for a future selloff or major scaling-back. "We have seen a very difficult security situation for a number of years … What really do we have as value-added in this?" he asked.

Van Beurden, who took over from Peter Voser at the start of 2014, confirmed that annual profits, on a current cost of supply basis, had slumped 48% to $16.7 billion despite very high oil prices, although U.S. gas prices have been low.

He is expected to give more details of his strategy after a management day on March 13. "We are making hard choices in our worldwide portfolio to improve Shell's capital efficiency," Van Beurden said.

"Our ambitious growth drive in recent years has yielded a step-change in Shell's portfolio and options, with more growth to come, but at the same time we have lost some momentum in operational delivery, and we can sharpen up in a number of areas," he added. Shares in Shell closed up 1% at £21.48.

Shell still has drilling interests in a range of territories, including the U.S. Gulf, Brazil, Norway, Russia and Mozambique.

Group spending is to be slashed this year by 20% to $37 billion and the moves to halt high-cost operations off Alaska were particularly welcomed by environmentalists.

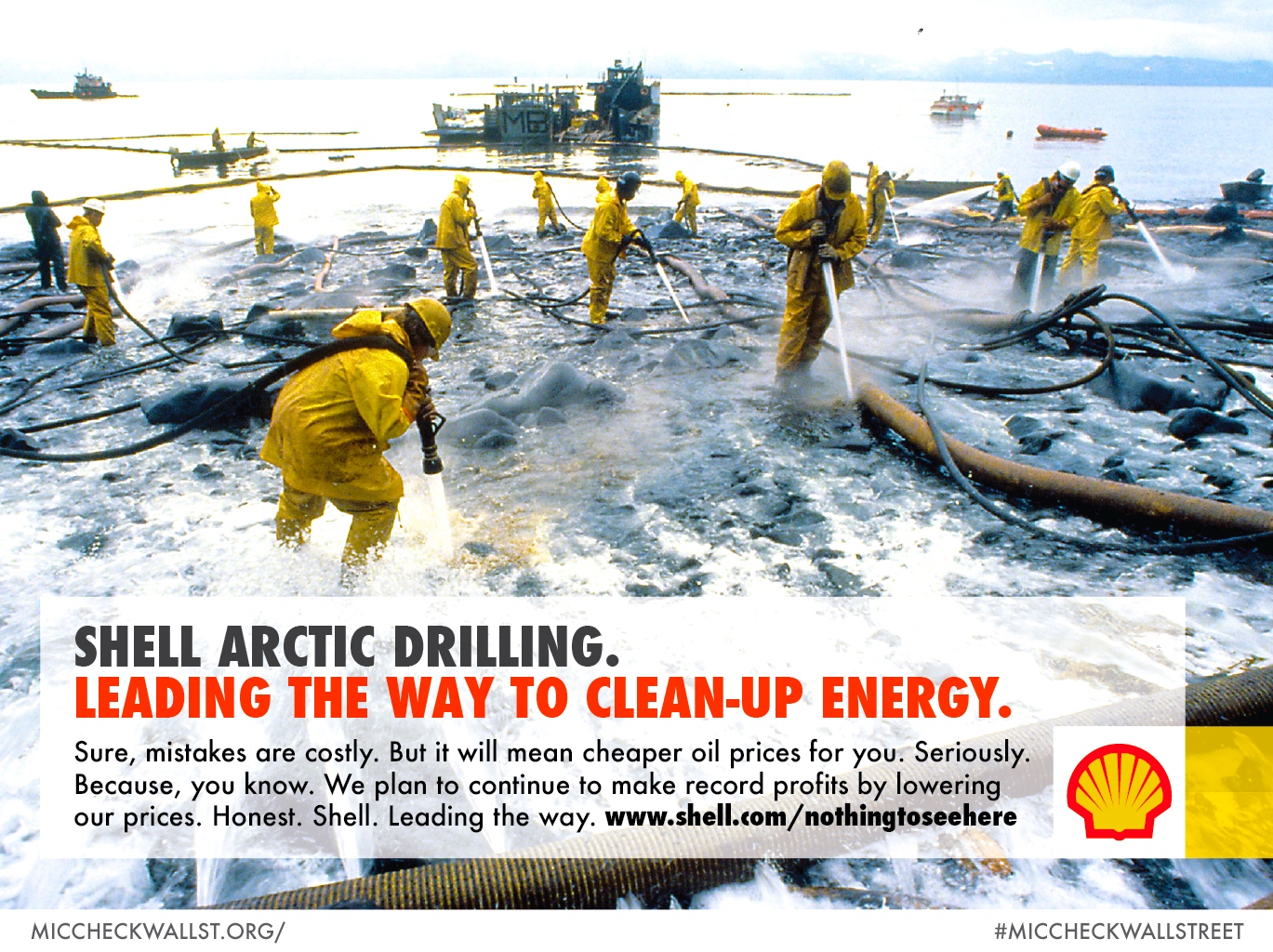

Greenpeace campaigner Charlie Kronick said: "The company has spent huge amounts of time and money on a project that has delivered nothing apart from bad publicity and a reputation for incompetence. The only wise decision at this point is for Mr. Van Beurden to cut his company's losses and scrap any future plans to drill in the remote Arctic Ocean."

Jacqueline Savitz, a vice-president at the Oceana conservation group, which had taken legal action to try to stop the oil company drilling, said: "Shell is finally recognizing what we've been saying all along: that offshore drilling in the Arctic is risky, costly and simply not a good bet from a business perspective."

The decision to shelve drilling off Alaska came alongside a $200m writeoff of expenses connected with the Kulluk drilling rig, which ran aground in 2012.

It also follows a U.S. court ruling that the US department of the interior had failed to consider all environmental impacts of exploration in the Chukchi and Beaufort seas when it gave Shell permission to drill.

"This is a disappointing outcome, but the lack of a clear path forward means that I am not prepared to commit further resources for drilling in Alaska in 2014," van Beurden said.

"We will look to relevant agencies and the court to resolve their open legal issues as quickly as possible," he added, indicating there could be huge writedowns emanating from the Arctic still to come.

Meanwhile Shell said it had distributed more than $11 billion to shareholders in dividends and expects to spend more in 2014. The basic financial results were known two weeks ago when the company issued a shock profit warning, but on Thursday Van Beurden brushed off suggestions that management must have seen the crisis coming and should have told the market quicker.

Total Backs Shale

The French oil group Total has taken a second bet on Britain becoming a significant shale gas producer.

Small independent shale pioneer Egdon Resources said it had sold off another part of its license in the Gainsborough concession in the Midlands. Total will also pay £13.5 million of exploration costs.

Earlier this month, the company took a 40% interest in two shale exploration licenses in Lincolnshire.

The move came on the day Shell reiterated that it had no current interest in U.K. shale. Shell is pursuing shale exploration in the U.S., Ukraine, China and Russia. But its financial turbulence means this year Shell will reduce its global spend on a search for shale resources from $6 billion to $5 billion.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments