This is the second installment in a seven-part series running throughout the week. Read the first part here.

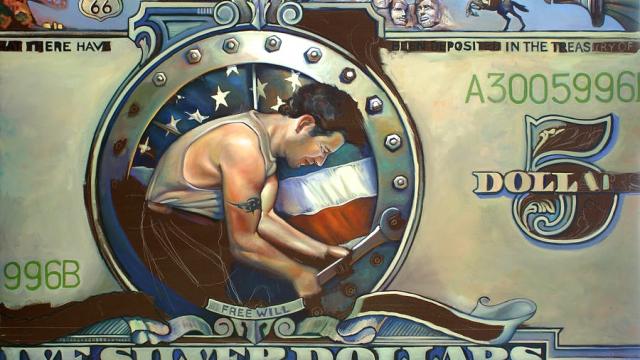

Finance Capitalism vs. Industrial Capitalism and their Respective Modes of Exploitation

These are indeed eternal problems between employers and employees. But today’s labor is exploited increasingly in a financial way. Corporate raiders empty out their pension funds (or at least, downsize pension payouts by threatening bankruptcy) and seize Employee Stock-Ownership Plans (ESOPs), while bankers charge labor directly by personal loans, mortgage loans, and student loans.

The Financial, Insurance and Real Estate (FIRE) sector has shifted the tax burden off itself onto consumers and financialized saving in advance for Social Security to produce a fiscal surplus that is used to cut taxes on the wealthy. The corporate sector and the economy at large have been “financialized,” their surplus consumed in the form of debt service rather than invested in new capital formation to employ labor and produce more to raise living standards.

What is important to realize is that most debt in today’s economies is taken on to buy real estate (housing and office buildings) and financial securities. Within the industrial sector, most corporate debt taken on for leveraged buyouts, or for “poison pills” as companies defend themselves against such financial aggression. To focus on the dynamics of industrial capitalism rather than those of finance capitalism leaves out of account the fact that banks make loans and create debt (and deposits) on their computer keyboards. An autonomous financial dynamic is at work, not merely savings by the industrial sector to be mediated by bankers.

Marx described the industrialists’ hatred of landlords and the wish from Ricardo through Henry George to create an industrial circular flow by minimizing land rent. The buildup of property claims and savings (owed by the economy’s renters and debtors) in the hands of rentiers is the result of industrial capitalism’s failure to complete its political destiny: freeing economies from postfeudal rentiers. Today’s financial power to set tax policy, make and enforce the law, and disable public regulation reflects the weakness of industrial capitalism in the face of the vested interests that have fought back against the Progressive reform movement since the 1870s.

Industrial capitalism’s familiar class conflict between employers and wage labor is now being overwhelmed by financial dynamics. It is appropriate to speak of debt pollution of the economic environment, turning the economic surplus into debt service for leveraged buyouts, real estate rents into mortgage interest, personal income into debt service and late fees, corporate cash flow into payments to hedge funds and corporate raiders, and the tax surplus into financial bailouts as banks themselves succumb to the economy’s plunge into over-indebtedness and negative equity.

The buildup of rentier wealth derives less from manufacturing than from real estate and monopolies, and most of all from finance. These rentier drives by the FIRE sectors are largely responsible for post-industrializing the economy. But that does not mean that matters can be reversed by “manufacturing more once again.” The industrial past cannot be recovered without winding down the debt overhead, topped by debt-leveraged prices for housing and commercial real estate, health care, education and pensions. Yet instead of confronting the financial problem, U.S. and European leaders blame China. They attribute its success entirely to manufacturing, not to the mixed public/private economy that has avoided privatization along financialized lines.

Misinterpretation of the West’s financial problem and its corollary untaxing of finance, insurance and real estate—and of China’s success in avoiding this takeover—reflects the success of rentiers in rejecting classical political economy’s doctrine of value and price, and its corollary distinction between earned and unearned income, and productive and unproductive labor. These concepts are no longer taught. Censorial neoliberal ideology has succeeded in expunging the history of economic thought from the curriculum and popular discussion.

This self-promotion by rentiers has gouged out a blind spot that is crippling economic policy today. Forecasting by correlation analysis and regression equations and kindred statistical model building assumes the status quo as far as the “environment” of institutional and tax structures is concerned. As “wealth creation” becomes an increasingly fictitious Enron-style “mark-to-model” accounting, academic economics likewise becomes more an exercise in science fiction depicting a kind of parallel universe. There is method behind its madness. The streamlining of economic theory along the lines of junk statistics has turned the discipline into bland public relations for the financial sector.

Classical economics was the political program of industrial capitalism seeking to free society from the rentier interests. Resisting the classical distinctions between productive and unproductive investment, credit and employment, the postclassical economists endorsed by the rentiers (receiving their charitable largesse as well as the “badge of true science”) insist that all income and wealth is earned productively. Everyone earns whatever he or she makes, so there is no unearned wealth. There are no “idle rich.”

This is the political service performed by the postclassical Austrian and “neoclassical” counter-revolution: denial that rentiers play an unnecessary role. The implication is that Balzac was simply writing fiction when he quipped (following Proudhon’s “Property is theft”) that the great family fortunes are grounded in long-forgotten and suppressed thefts of the public domain and by financial and political insider dealing. One indeed finds more description of how great fortunes are made from novelists than from economists. When it comes to wealth and the power elite, today’s economic models barely scratch the surface.

Today’s austerity is being imposed to squeeze out more debt service. This requires either the suspension of democratic government in debt-strapped countries, as in Greece (where Angela Merkel dissuaded the Prime Minister Papandreou from submitting the European Central Bank’s austerity plan to a voter referendum), or political distractions to convince voters to elect neoliberal parties on a platform of ethnic nationalism or other noneconomic issues, as in Latvia and its Baltic neighbors. As economic growth gives way to shrinkage (except for public and private debt overhead and the concentration of property ownership), what seemed to be the long-term trend of parliamentary reform over the past two centuries is being reversed.

Turning economic theory into a logic justifying rentier wealth distracts attention from the widening rake-off of economic rent and financial extraction. The assumptions made by neoliberal orthodoxy deny in principle that what is happening can really be occurring at all! The hope is that people look at the map, not at the territory. It is a false map, turning academic economics into science fiction about a happy parallel universe where everyone is fairly rewarded and the world becomes more equal and prosperous.

In the real world, “balance sheet wealth” has become financialized. This means debt-leveraged—and increasingly post-industrialized. Under industrial capitalism, profits were made by investing in plant and equipment to employ labor to sell goods (and a widening array of services) at a markup. Most profits were to be reinvested in this way, including research and development. And today, retained earnings continue to be the main source of tangible capital investment—not bank lending, the stock market, or other external financing.

Two surgeons, Dr. William Petty in Ireland and Dr. Francois Quesnay in France, used the analogy of the circular flow of blood in the human body for how national income is circulated between producers and consumers, employers and employees (known popularly as Say’s Law), and between the government and the private sector.

The Great Depression saw this circular flow interrupted. The siphoning off had been occurring ever since feudal times by rentiers extracting access charges for basic needs. Keynes blamed the depression on saving and hoarding out of the circular flow. But the problem today is the diversion of consumer income (wages), corporate cash flow, and public tax revenues to pay interest and amortization. This leaves less available for spending on goods and services.

The banks and other financial institutions and creditors receiving this debt service do not use it to finance tangible investment. They lend out their revenue to become additional debt claims on the bottom 99 percent of families, and on corporate industry and governments.

To minimize this diversion of revenue, industrial capitalism had to confront the vested interests entrenched from feudal Europe’s epoch of military conquest: a landed aristocracy and banking families. Paying rent and interest for access to land and credit diverted the circulation of income between production and consumption. Malthus argued that landlords spent their rent on coachmen, tailors, and servants. But most classical economists deemed such spending unproductive because it did not employ wage labor to produce goods to sell at a profit.

As real estate has become democratized, buyers can obtain housing and commercial property by borrowing mortgage credit. The winning buyer is whoever outbids others to pledge the most rent to the bank as interest in exchange for a loan. The purchase price usually ends up with the entire rent being pledged—and sometimes the anticipated capital gain as well. This makes banks the recipients of the groundrent that was paid to landlords prior to the 20th century.

Banks also pressed governments to create commercial privileges and other monopolies. They traded in government bonds for the infrastructure and trading rights being sold off. To the extent that these public enterprises were bought largely on credit, their extraction of monopoly rent, like land rent, ends up being paid out as interest as these rights are traded and sold.

The symbiosis between banking and government was the agreement that government bonds would be the foundation of most bank reserves. Most of this public debt originated as war debt, because wars traditionally are the major cause of budget deficits. Adam Smith urged nations to finance wars on a pay-as-you-go basis so that populations would feel the immediate expense and make an informed choice for peace instead of burdening economies with war debts owed to financiers. The way to bring prices in line with the technologically necessary costs of production— and hence to win export markets—was thus to replace war with peace. Minimizing or taxing away land rent, monopoly rent and financial charges became the dream of classical economics as a political reform program.

Stay tuned for Part III in the series

Read Part I in the series

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments