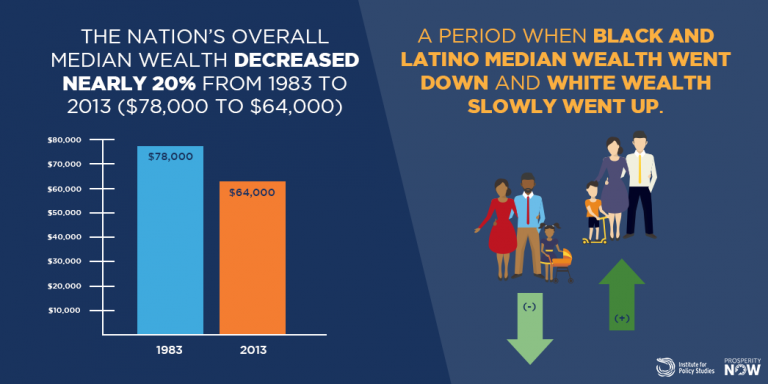

A new study finds that if the racial wealth divide is left unaddressed, the median wealth for black Americans will fall to $0 by 2053, with Latino Americans reaching the same median wealth two decades later.

According to the report by the Institute for Policy Studies and Prosperity Now, the wealth gap between people of color and their white counterparts is showing no sign of narrowing in the coming years – even as racial demographics in the U.S. are rapidly shifting, with people of color projected to make up the majority of the population by 2043.

In the next three years, black households are projected to lose 18 percent of their median net worth, while white families are expected to gain about three percent more wealth.

The report, “The Road to Zero-Wealth,” defines middle-class wealth as a household net worth of $68,000 to $204,000, and notes the disconnect between income and wealth: a median income for one’s racial background does not guarantee entry into the middle-class.

“White households in the middle-income quintile – those earning $37,201-61,328 annually – own nearly eight times as much wealth ($86,100) as Black middle-income earners ($11,000) and ten times that of their Latino counterparts ($8,600),” write the authors.

Black Americans are also unable to accumulate middle-class wealth even with high levels of education:

"If we consider educational attainment – often considered as the “great equalizer” between the rich and the poor and between families of different racial and ethnic backgrounds – White families whose head of household holds a high school diploma have nearly enough wealth ($64,200) to be considered middle class. A typical Black or Latino family whose head of household has a college degree however, owns just $37,600 and $32,600, respectively, in wealth."

In addition to impact of income inequality on individual families, the racial wealth gap has increasingly dire implications for the overall economy if, as the authors project, the majority of Americans aren’t able to enter the middle class:

"If the racial wealth divide continues to accelerate, the economic conditions of black and Latino households will have an increasingly adverse impact on the economy writ large, because the majority of U.S. households will no longer have enough wealth to stake their claim in the middle class."

The report emphasizes the severe economic disadvantage black Americans had throughout the 20th century as the middle class grew. While the G.I. bill offered millions of veterans and their families access to home ownership, higher education, and business loans, the authority of individual states to implement the bill with little oversight led to “pervasive racial discrimination in which service members of color were more likely to be denied access to a range of benefits that greatly expanded the American middle class.”

Meanwhile, black Americans have been subjected to redlining and other discriminatory practices, creating a vicious cycle in which households are refused credit as a penalty for living in low-income areas – in turn making it impossible, in many cases, to move into the middle class.

To combat the growing racial wealth divide and to keep it from resulting in a further-weakened middle class, the study urges, among other things, a correction of the country’s “upside-down” tax structure in which the government would “stop subsidizing those who are already wealthy and start investing in opportunities for low-wealth families to build wealth.”

“The growing racial wealth divide documented in this report is not a natural phenomenon, but rather the result of contemporary and historical public policies that were intentionally or thoughtlessly designed to help White households get ahead at the expense and exclusion of households of color,” the report reads. “Although public policy has been a significant contributor to the divide, the good news is that public policy can also help to close the divide.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments