Jamaican-born cultural theorist Stuart Hall once said that “you don’t need to have a fight about privatization, [so long as you] erode the distinction between public and private.”

Goldman Sachs’s most recent philanthropic foray into the rehabilitation of youth offenders surely brings Hall’s portension to life.

Goldman Sachs—the fifth largest U.S. financial institution—recently announced its intention to invest $2.4 million in MDRC (Manpower Research Demonstration Corporation), a non-profit social services provider overseeing a program housed at New York City’s Rikers Prison aimed at reducing the recidivism rate among male inmates aged 16 to 18 by ten percent over the next four years. Mayor Bloomberg’s personal foundation—Bloomberg Philanthropies—has agreed to chip in another $7.2 million.

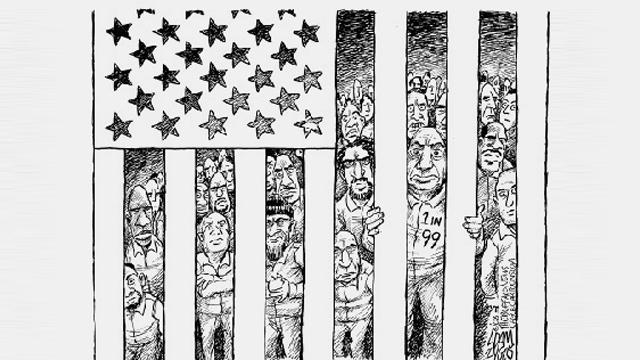

Recidivism refers to the rate at which prisoners re-enter or return to jail/prison three years or less after their release. The recidivism rate at Rikers currently stands at 66 percent and far outstrips the New York state average, which has hovered around 40 percent for the last decade.

So just how magnanimous is Goldman Sachs? You decide. In the second quarter of this year, Goldman reported a profit of $962 million.

Goldman Sachs’s loan to MDRC is a new type of U.S. investment instrument called a “social impact bond” whose purpose is to employ market incentives to garner private funding for public social challenges.

Here’s how it works:

Goldman Sachs's plans to invest $2.4 million in the Rikers program over the next four years by structuring its venture as a loan to MDRC. MRDC will simultaneously enter into contract with New York City.

If MDRC succeeds in reducing recidivism rates by 10 percent over four years, then the city’s Department of Corrections, with the help of the Bloomberg Foundation, will give MDRC the money it needs to repay Goldman Sachs for the loan. Should MDRC reduce recidivism by 20 percent, and then Goldman could stand to make an additional $2.1 million.

If, however, MDRC falls short of its initial benchmark then Goldman will lose its entire $2.4 million investment. Here’s the irony: Goldman Sachs could simply decide to hire ex-youth offenders leaving Rikers to work for their company thereby reducing recidivism to a percentage that would ensure a handsome return-on-investment. This, of course, altogether defeats the purpose of long-term publicly supported recidivism reduction strategies.

Although social impact bonds are just now being introduced in the United States they’ve been quite popular in the U.K. over the last few years. Philanthropists across the pond extol social impact bonds for their innovative “contingent returns model,” colloquially known as their “pay-for-success” structure. Citizens, however, should still remain cautious of public-private-partnerships for the reason that if/when a program or investment “fails,” a corporate investor can abscond and the state has no other option but to compensate for the slack. This is the cauldron in which austerity simmers.

If we’re truly dedicated to reducing recidivism, then perhaps we should attend less to the perceived merits of “social impact bonds” and instead fund our public schools (to stanch the flow of the school-to-prison pipeline), increase the minimum wage and index it to inflation, extend the Earned Income Tax Credit (EITC) ceiling to cover more low-income families, eliminate payroll taxes for those making less than $20,000/year, create a modern-day WPA, and reinstate Pell Grants for prisoners seeking to pursue an education while incarcerated. We must also demand that corporations in the financial services sector pay their fair share in taxes. Investing $2.4 million in recidivism reduction is a drop in the bucket for Goldman Sachs, a corporation that successfully lobbied to reduce its tax liability by $420 million from 2010 to 2011.

And this is precisely the point. Lauding the supposed magnanimity of Goldman Sachs and the experimental and entrepreneurial nature of “social impact bonds” further erodes the critical distinction between public good and private gain.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments