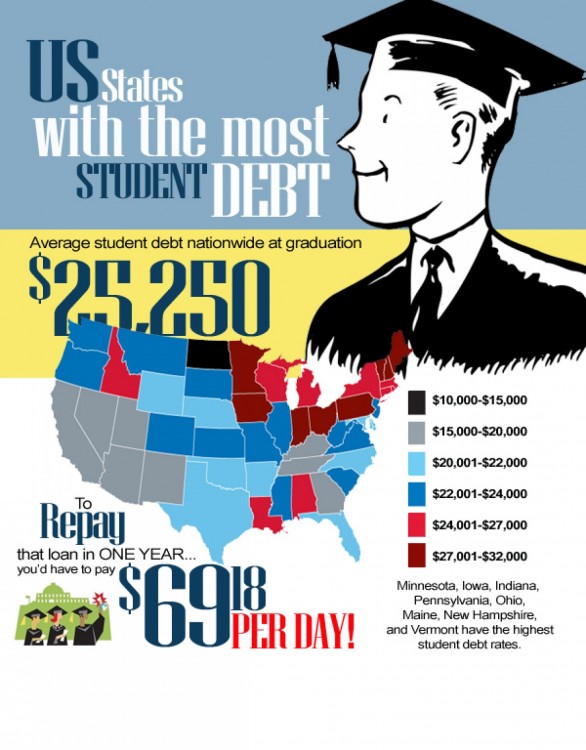

Over the past two decades, the amount of money a college student must borrow to pay for their education has doubled. The graduates of 2014 now sit at the top of the class in student debt. Tuition fees have risen dramatically as household incomes have stagnated, at best, causing some 70 percent of students to fund their higher educations through loans.

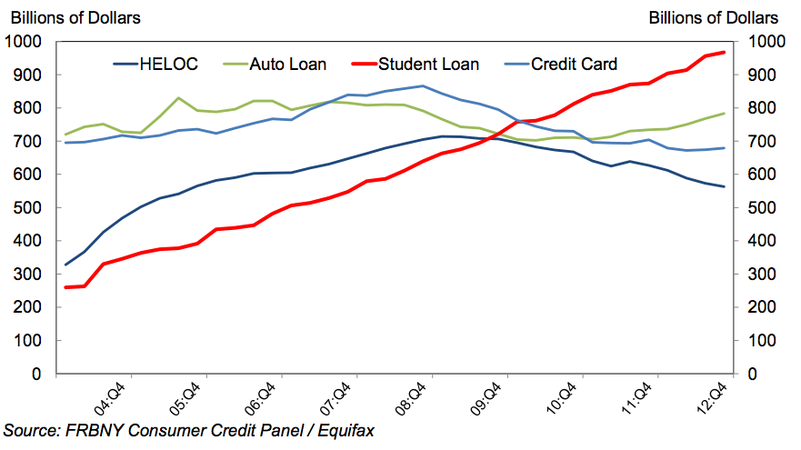

During the recession, the student debt issue really picked up steam as these kids entered a lackluster workforce, on average, $30,000 in the red, if they earned a bachelor's degree. Because many of them fell behind on their loan repayments during that time, many economists feel that the estimated $1.2 trillion of student debt continues to weigh down our forward economic momentum. And that's not even counting money borrowed from non-loan sources like credit cards, home equity, and retirement plans.

That's where Seattle's Salish Sea Cooperative Finance comes in. As a social enterprise, SSCoFi "refinances high-interest student loans in Washington by reinvesting its members’ financial resources." The basic premise relies on the fact that the community can – and should – invest in the education of its future leaders.

It's a win-win scenario as the graduates get a little break on their payments while the investors enjoy a solid profit margin, and all of those assets stay within the community. It's sort of like Lending Club, but for local college graduates.

Three separate demographics can become members of the democratically controlled SSCoFi:

Student Debtors: Graduates who already have student loans.

Benefactors: People who are willing to support the student debtors with donated funds, loan guarantees, or co-signing.

Investors: People who are looking for a socially responsible way to invest money in their community and return a profit.

Their call to action:

We are calling for student-debtors, investors, benefactors, and advisors who will come together to support a community-based approach to address student debt, increase the economic well-being of students in the community, and return the profits to the community rather than big banks.

If SSCoFi can make this wonderfully shareable format work, the model can be replicated all over the country and scaled to fit any community.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments