A campaign to root out financial fraud secured a victory on Wednesday, as authorities took aim at the Royal Bank of Scotland for its role in an interest rate manipulation scheme that has emboldened prosecutors and consumed the banking industry.

American and British authorities struck a combined $612 million settlement with the bank, the latest case to emerge from the global investigation into rate-rigging. The Justice Department dealt another blow to the bank, forcing its Japanese unit to plead guilty to criminal wrongdoing.

The penalty for the subsidiary, a hub of rate manipulation, underscores a recent shift in the way federal authorities punish financial wrongdoing. The R.B.S. case echoed an earlier action taken against a UBS subsidiary, which similarly pleaded guilty to felony wire fraud as part of a larger settlement. These cases represent the first units of a big bank to agree to criminal charges in more than a decade.

“I want financial institutions to know that this department will absolutely hold them to account,” Lanny Breuer, head of the Justice Department’s criminal division, said in an interview Wednesday.

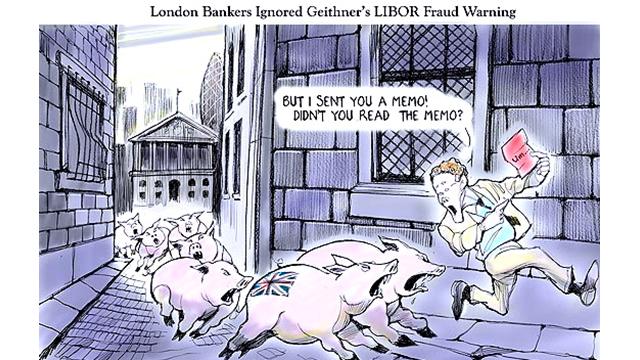

Some of the world’s largest financial institutions remain caught in the cross hairs of the rate manipulation case, an investigation that could drag on for years. Authorities suspect that more than a dozen banks falsified reports to influence benchmarks like the London Interbank Offered Rate, or Libor, which underpins the costs for trillions of dollars in financial products like mortgages and credit cards.

A person involved in the investigation indicated that the first banks to settle were among the worst actors in the rate case. But they also received a “discount” for their eager cooperation, according to people with knowledge of the matter.

That approach raises the prospect that remaining banks could face high-priced settlements.

Deutsche Bank, which set aside an undisclosed amount to cover potential penalties and suspended five employees tied to the case, is expected to settle with authorities in late 2013, several people briefed on the matter said. But the timetable could shift. The bank is not in formal settlement talks and is not prepared to resolve the case, the people said.

While foreign banks have borne the brunt of the scrutiny, an American institution could be among the next to settle. Citigroup and JPMorgan Chase are under investigation by the Commodity Futures Trading Commission, the American regulator leading the case, though actions are not imminent.

The R.B.S. action concluded a first phase of rate-rigging investigations for authorities, who are now planning to take a brief hiatus from filing cases. The next case is not expected until spring at the earliest, two of the people briefed on the matter said.

Some bank executives, fearful that fallout from the case will stain their firms, are pushing for a broad deal encompassing multiple institutions. But authorities are balking at a “global settlement,” people involved in the case say, arguing that investigations are proceeding at different stages and involve widely varying fact patterns.

As regulators continue to pursue actions, prosecutors are planning charges against traders involved in the scheme. The first charges came last year when the Justice Department filed actions against two former UBS traders.

“Our investigation is far from finished,” Mr. Breuer said.

The rate-rigging case has centered on how much banks charge each other for loans. Such figures form the basis of Libor and other rates. But banks corrupted the process. Government complaints filed over the last year outlined a scheme in which banks reported false rates to lift trading profits.

Authorities announced the first Libor case in June, extracting a $450 million settlement with the British bank Barclays. In December, UBS agreed to a record $1.5 billion settlement with authorities. The Justice Department also secured the guilty plea from one of the bank’s subsidiaries.

Royal Bank of Scotland, based in Edinburgh, had aimed to avert the guilty plea for its Japanese subsidiary, people involved in the case said. But the Justice Department’s criminal division declined to back down, and the bank had little leverage to push back. It decided not to formally appeal its case to Attorney General Eric H. Holder Jr., another person said.

With fines coming from multiple authorities, the $612 million case amounted to the second-largest penalty levied in the multiyear investigation into rate manipulation. “The settlement with R.B.S. is much more than a slap on the wrist,” argued Bart Chilton, a member of the trading commission who is critical of soft fines on big banks.

The settlement represents the latest setback for Royal Bank of Scotland, which has struggled to shake the legacy of the 2008 financial crisis. The British firm, which is majority-owned by the government after a bailout, already has put aside $2.7 billion to compensate customers who were inappropriately sold loan insurance in recent years.

Since the financial crisis, the bank has shaken up its management team and refocused its operations, as part of an effort to repair its bruised image. On Wednesday, it announced plans to claw back bonuses to help pay for the latest settlement.

At a news conference in London on Wednesday, Stephen Hester, the bank’s chief executive, admitted that the rate-rigging episode significantly strained the bank. “It is one of the most difficult moments over the entire period,” he said.

As authorities stitched together the R.B.S. case, they seized on a series of colorful e-mails that highlighted an effort to influence the rate-setting process, a plot that spanned multiple currencies and countries from 2006 to 2010. One Royal Bank of Scotland trader mused in a 2007 message how the process was becoming a “cartel,” adding “its just amazing how libor fixing can make you that much money.”

The wrongdoing spread broadly, authorities say, noting that Royal Bank of Scotland “aided and abetted” UBS and other firms. A senior official at the Justice Department’s antitrust unit, Scott D. Hammond, contends that the bank “secretly rigged” interest rates.

A UBS trader, the department said, once asked a co-worker to “have a word with” another bank about Libor submissions. The UBS trader, Thomas Hayes, who was recently charged by the Justice Department with fraud, indicated that he had already approached R.B.S. for help.

The government complaints also portray a permissive culture that allowed rate-rigging to persist for four years. David Meister, the enforcement director of the trading commission, declared that “the environment was ripe for manipulation at R.B.S.”

The bank’s own records captured the scheme in striking detail, revealing how traders pressured other employees to submit certain rates. Submitters and traders sat in earshot of each other in London, forming what authorities termed a “cozy ring.” The bank eventually separated the employees, who then moved to make additional requests via instant messages.

To persuade employees who submitted Libor rates, some traders promised affection. Others offered steak and sushi. One trader resorted to begging, invoking a plea of “pretty please.” Another trader, after pressuring a colleague to submit a certain rate, offered a reward of sorts: “I would come over there and make love to you.”

When authorities began scrutinizing the bank, the traders adopted a more covert approach. In 2010, a Libor submitter rebuffed an instant message request to influence rates. But then the submitter called the trader to explain “we’re not allowed to have those conversations” over instant message.

The employees laughed, according to a transcript of the call, and the submitter reassured the trader that he would fulfill the request: “Leave it with me, and uh, it won’t be a problem.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments