The American people pay a similar amount for social services – health care, retirement security, disability and unemployment insurance and the like – as citizens of European countries with supposedly lavish social safety nets.

But there are two significant differences. First, we pay a hugely disproportionate share of the costs out-of-pocket, through the private sector. And when things go badly – when misfortune hits — the safety net that we fall back on is truly pathetic in comparison. Call it the great American rip-off.

Nobody needs to tell Leslie Boyd, a former newspaper reporter in North Carolina, about the human costs of this. Her son, Michael Danforth, was born with a defect that made him more likely than most to contract colon cancer. “He could not get insurance at any cost,” she told Moyers & Company, “and he needed colonoscopies every year” to screen for the disease. Danforth’s doctor demanded immediate payment for services rendered – $2,300 for the procedure. “My son was a student so he didn’t have the money,” recalls Boyd. “He didn’t tell me because he didn’t want me to worry.”

Danforth skipped the screening. Two years later, he got sick. He went to emergency rooms for the acute pain he was suffering, but was misdiagnosed three times. The six-footer weighed just 110 pounds when he was finally admitted to a hospital. “His kidneys had already shut down and they found cancer,” says Boyd. “And it had spread — it was too late to save his life.”

Danforth’s wife had a part-time job, which gave the couple too much income to qualify for Medicaid, so they split up as his condition worsened. He applied for Social Security disability benefits but it took 37 months for his application to be processed.

“The first check came nine days after he died,” says Boyd. He was 33 years old.

The High Cost of Low Taxes

Delinking taxes from the services they pay for has arguably been the modern conservative movement’s greatest success. No politician has ever been booed off a stage for promising to cut taxes. But decades of public opinion polling shows that, with a few exceptions, Americans are actually quite fond of the goods and services the public sector provides. They may be wary of the idea of “big government” in the abstract, but they like well-maintained infrastructure, safe food and clean water, efficient firefighting and policing, Medicare and Social Security and virtually every other government-provided service you can name.

This paradox is well known to politicians and policymakers, and has caused a good deal of hand-wringing among those who favor a progressive tax system that raises enough funds to cover the services Americans expect. But there’s another consequence of anti-tax demagoguery: low, low taxes come with a steep cost. In fact, a lower tax bill – especially for federal taxes — actually works against the economic interests of most Americans.

That’s because we pay ridiculously high out-of-pocket costs for things that are provided by the public sector in other developed countries. The difference is quite dramatic. The Organization for Economic Cooperation and Development (OECD) — also known as “the rich countries club” — tracks both public and private financing of social spending. Americans pay almost four times as much as the citizens of other wealthy countries for things such as retirement security and health care on the private market – 10.6 percent of our economic output versus an average of just 2.7 percent among OECD member states.

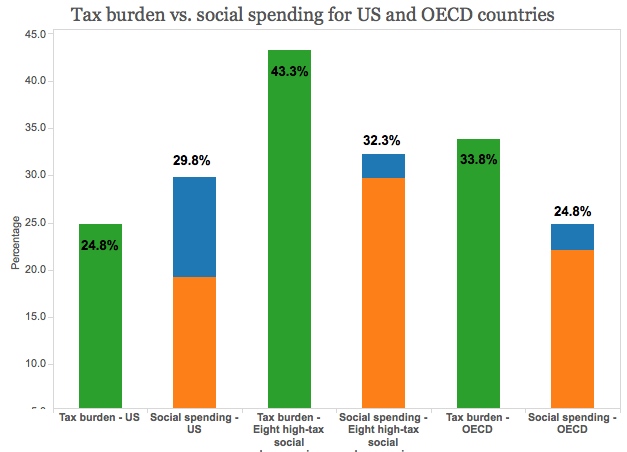

Contrary to popular belief, American families and corporations enjoy relatively low taxes – in the OECD, we ranked third from the bottom in total tax burden in 2010 – but it’s almost a wash when you add back what we spend out-of-pocket. The eight OECD countries with the highest tax burdens in 2010 (Denmark, Sweden, Norway, Belgium, Italy, France, Austria and Finland) paid out an average of just over 32 percent of their economic output for social services, while we forked over just under 30 percent.

The difference is that we ranked near the bottom in the OECD (26th out of 34 countries) in terms of public spending on these services. Government-provided services accounted for around 19 percent of our gross domestic product (GDP), compared with 29 percent of GDP in those high-tax countries. The difference was made up from out-of-pocket spending by citizens.

Breaking it Down

Consider some basic social safety net services and other OECD data:

*An American losing a job that paid an average wage will get 47 percent of his or her income replaced by unemployment over the short term. The average replacement rate is 55 percent across the OECD and 57 percent in those eight social democracies.

*A single American parent of two down on his or her luck will be eligible for cash and in-kind benefits (welfare, housing assistance, food stamps, etc.) equal to 24 percent of the median income. The same person would see an average of 40 percent of the median across the OECD.

*Our public pension system – Social Security – replaces just over 39 percent of average earnings. In the eight social democracies with the highest tax burdens, that figure is almost 54 percent.

*Only seven of the 34 countries in the OECD had shorter average life expectancies than U.S. citizens in 2008. Between 1983 and 2008, average life expectancy grew by six years across the OECD; in the U.S., we gained a little over three. And only three OECD countries – Chile, Mexico and Turkey – have higher rates of infant mortality.

*During the Great Recession, the social safety nets in the eight social democracies kept poverty rates in those countries significantly lower than in the U.S. Only three OECD countries – Mexico, Chile and Israel – had a higher rate of poverty than the U.S.

Family Values

Yet those data don’t capture the simple truth that citizens of other wealthy countries enjoy benefits that Americans can only dream of – things like publicly funded pre- and after-school programs, paid maternity and paternity leave, and wage replacement for people who suffer from extended illnesses.

Perhaps the most dramatic differences in our priorities are reflected in public expenditures on family support. Only two OECD members devote less of their economic output to these benefits: South Korea and Mexico. And we spend dramatically less than the rest – 60 percent less than the OECD average.

The Great Risk Shift

That Americans pay through the teeth for social services isn’t an accident. It’s the result of decades of policymaking based on what’s been sold as an “ownership society.” Yale political scientist Jacob Hacker called it a “personal responsibility crusade” that’s been firmly embraced by corporate America and conservative politicians.

In his book, The Great Risk Shift, Hacker detailed how a huge share of the retirement security and health care burden has been shifted from employers and the government onto the backs of working people themselves. These are the insurances that mitigate one’s risk in a capitalist society, and their loss has left American families exposed and economically insecure. “Social Security, Medicare, private health insurance, traditional guaranteed pensions – all sent the same reassuring message: someone is watching out for you, all of us are watching out for you, when things go bad,” wrote Hacker. “Today, the message is starkly different: You are on your own.” And it turns out that it’s a pretty costly message.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments