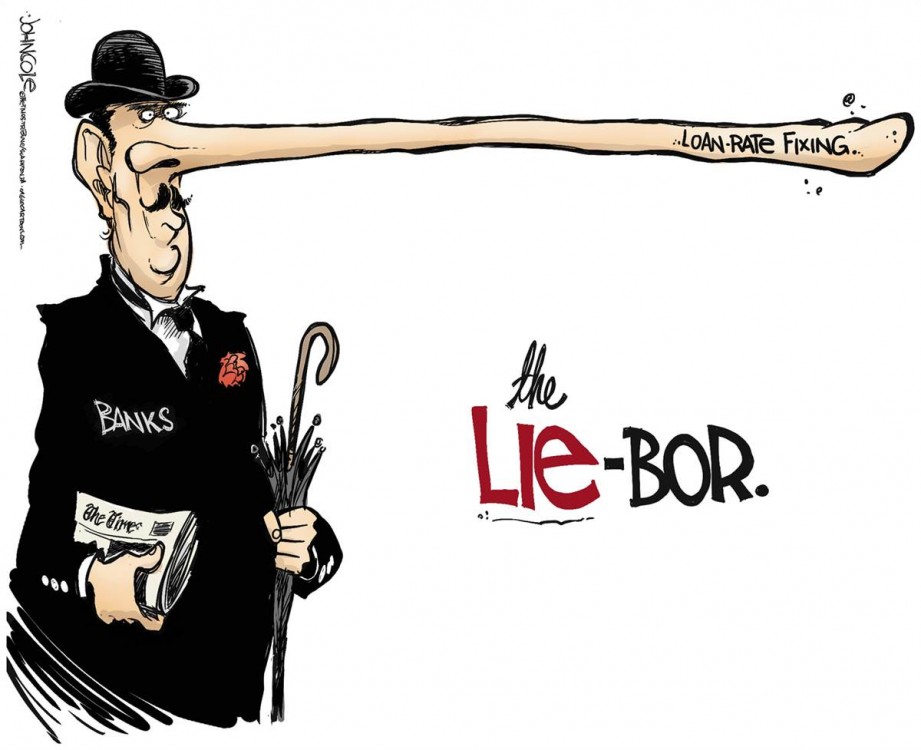

Five years ago it emerged that the LIBOR interest rates, the world’s most influential and important financial benchmark, were rigged. New revelations suggest that not only was this fraud a systemic practice by big banks, but Bank of England and the government in Westminster were also in on the big fix.

What is LIBOR?

The London Interbank Offering Rate is an interest rate based supposedly on the rates banks will lend money to each other, set on a daily basis. LIBOR directly impacts over $350 trillion in worldwide financial products. If you have a mortgage, student loan or other financial tie, these products are likely tied to the rate. Local councils’ and public organisations’ financial investments are determined by LIBOR. It affects everything.

To manipulate the rate, banks gave false rates, higher or lower than they would actually lend money for. Rate-setters were influenced by traders who had bets on the rate going a certain way; these traders made fortunes for themselves and the banks, returning the favor in extravagant holidays and other gifts. On the other side of the equation, unsuspecting customers, institutions and the public lost out.

The bankers even rigged LIBOR to cash in even more from the bank bailout. In 2012, Timothy Geithner the U.S. Treasury Secretary, admitted that banks rigged the U.S. bank bailout. Lloyds of London was fined for rigging the rate connected to its U.K. state assistance. The LIBOR rigging alone could be grounds to declare the bank bailouts illegal.

Not Just "a Few Bad Apples"

One of the over-arching myths surrounding the LIBOR rigging was that it was caused by a few bad apples. This narrative was the same one pushed when the whole financial world crashed a few years previously. But the more we understand about both LIBOR and the financial crash, the more blatant is the evidence of systemic, wholesale corruption throughout the financial industry.

Since the LIBOR scandal broke, only a few low-ranking traders from UBS, Citigroup and Barclays have found themselves in jail, among them Tom Hayes, who was sentenced to 14 years. Yet to this day, none the top bankers have joined them. Equally disturbing, the banks fined for rigging the rate have only been forced to pay out in the hundreds of millions. This amounts to loose change for the LIBOR fraud and profiteering that they successfully undertook.

Fraud From on High

Earlier this month, a BBC Panorama documentary further lifted the lid on the scandal by releasing a telephone recording made between Mark Dearlove and Peter Johnson. Dearlove headed Barclays Japan, and Johnson was a LIBOR submitter responsible for giving an interbank offering figure for the bank.

In the recording, which took place Oct. 29, 2008, Dearlove said: "The bottom line is you're going to absolutely hate this... but we've had some very serious pressure from the U.K. government and the Bank of England about pushing our Libors lower."

Johnson, who is now serving four years for LIBOR fixing, objected to the request for legal reasons. To this, Dearlove replied, "The fact of the matter is we've got the Bank of England, all sorts of people involved in the whole thing... I am as reluctant as you are... these guys have just turned around and said just do it."

Dearlove is currently under investigation by the U.K. Serious Fraud Office.

The same day as that phone call was made, Paul Tucker, Executive Director at the Bank of England, called Bob Diamond, chief of Barclays. The BBC reported that LIBOR was also discussed on this call.

These allegations contradict claims made by both Diamond and Tucker to Parliament that they were unaware of lowballing, that is, setting LIBOR interest rates lower to give the impression that the bank was healthier during the financial crash. Lowballing, just like inflating LIBOR rates, gave traders the chance to cash in.

In response, the Bank of England said that LIBOR and other global benchmarks “were not regulated in the U.K. or elsewhere during the period in question” and that they would help the Serious Fraud Office with their enquires.

By not denying the allegations, the Bank of England effectively admitted it was complicit in fixing LIBOR. Presumably the bank's motivation was to give a false impression that might steady the collapsing economic system. It's actions also enabled and condoned further systemic profiteering.

Conservative Party Complicity

The new revelations serve only to further tarnish the argument that this was all the work of some rogue traders. As Occupy.com reported in 2013, LIBOR rigging charges have also been levied against members at the top of the U.K. Conservative Party.

ICAP, the FTSE 250 trading and bank brokerage firm, was described in late 2013 as a “lynchpin” in the LIBOR scam, where low level employees have been found guilty of rate rigging. ICAP is run by the Conservative Party’s former top treasurer and donor, Michael Spencer. Spencer, who was not charged for a role in LIBOR, nonetheless adamantly pushed the "rotten apples" narrative.

Another strong connection between LIBOR and the Conservatives is Angela Knight, a former MP (1992-97) and prominent figure in the London. She was Chief Executive of the British Banker’s Association, a lobby group for banks, and kept her knowledge about LIBOR rigging secret since 2005. The truth spilled out once she spun back through the revolving door and became the government’s tax advisor in 2016.

As Knight's experience showed, the way that bankers move from being politicians to regulators and back again speaks volumes about why LIBOR and other systemic fraud often remain unresolved. Where there is no political will, there is no way. The City of London and the Conservative Party are not only connected via the revolving door: the city in fact bankrolls the party and has become its main donor in the years since the financial crash.

In opposition, the Labour Party has called for an open public enquiry into LIBOR rigging – demands that have become all the more urgent with a forthcoming snap election called by Theresa May last week. Shadow Chancellor of the Exchequer John McDonnel said of the enquiry: “It is essential that we clarify who took the decisions to rig the Libor index, and when, so that the schools, NHS hospitals and local councils that lost out can be paid the compensation that is rightfully due and public confidence in our banking system and official institutions can be restored.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments