Former fashion jewelry saleswoman Rebecca Gonzales and former Chief Executive Officer Ron Johnson have one thing in common: J.C. Penney no longer employs either.

The similarity ends there. Johnson, 54, got a compensation package worth 1,795 times the average wage and benefits of a U.S. department store worker when he was hired in November 2011, according to data compiled by Bloomberg. Gonzales’s hourly wage was $8.30 that year.

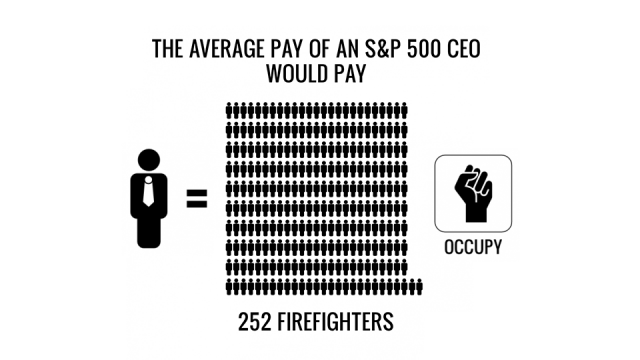

Across the Standard & Poor’s 500 Index of companies, the average multiple of CEO compensation to that of rank-and-file workers is 204, up 20 percent since 2009, the data show. The numbers are based on industry-specific estimates for worker compensation.

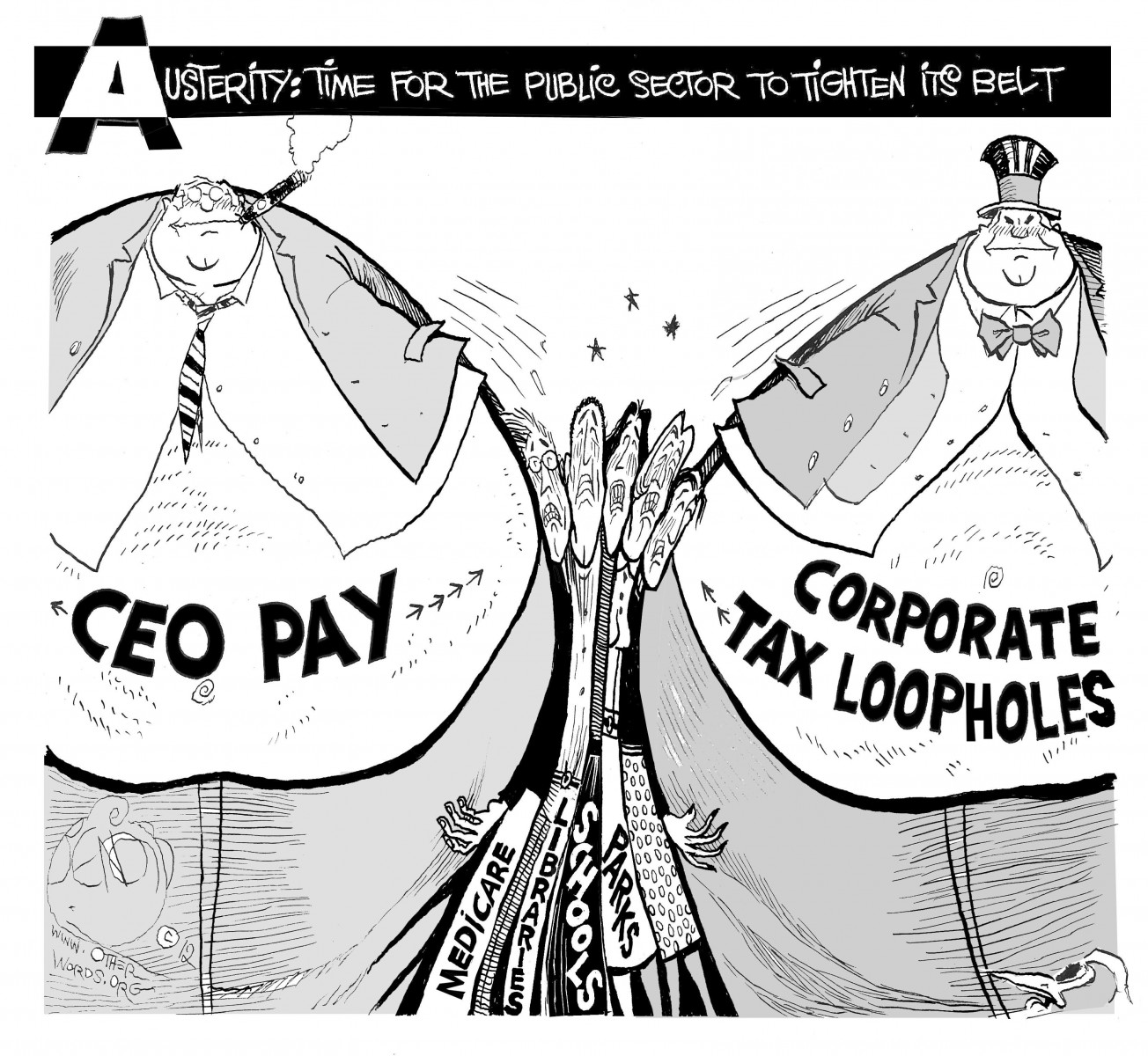

Almost three years after Congress ordered public companies to reveal actual CEO-to-worker pay ratios under the Dodd-Frank law, the numbers remain unknown. As the Occupy Wall Street movement and 2012 election made income inequality a social flashpoint, mandatory disclosure of the ratios remained bottled up at the Securities and Exchange Commission, which hasn’t yet drawn up the rules to implement it. Some of America’s biggest companies are lobbying against the requirement.

“It’s a simple piece of information shareholders ought to have,” said Phil Angelides, who led the Financial Crisis Inquiry Commission, which investigated the economic collapse of 2008. “The fact that corporate executives wouldn’t want to display the number speaks volumes.” The lobbying is part of “a street-by-street, block-by-block fight waged by large corporations and their Wall Street colleagues” to obstruct the Dodd-Frank law, he said.

Brand-Name Opposition

The leading opponent of mandatory pay-ratio disclosure is a Washington-based non-profit called the HR Policy Association, which represents top human resources executives at about 335 large corporations.

“We don’t believe the information would be material to investors,” said Tim Bartl, president of the group’s advocacy arm, the Center on Executive Compensation. Accounting for country-to-country differences in wages and benefits at global companies would be costly, time-consuming and all but impossible, he said in an interview.

The group has brand names behind it: 17 companies on HR Policy’s board of directors have CEO pay ratios in the top 20 percent of S&P 500 corporations, Bloomberg data show. They include General Electric, with a ratio of 491; McDonald’s, at 351; and AT&T, at 339.

Growing Ratio

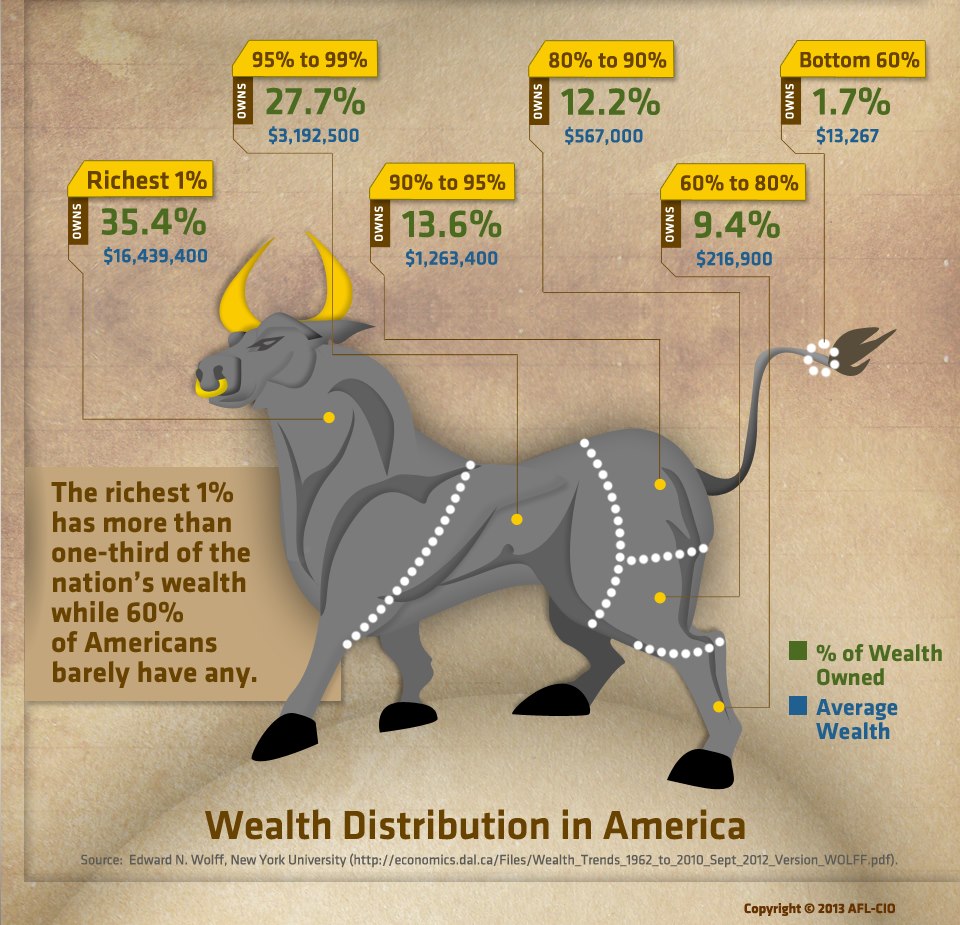

These multiples are based on CEO pay for either the fiscal year ending in 2011 or 2012, as disclosed in the companies’ most recent filings before noon on March 26. Because most companies don’t disclose their average workers’ pay, Bloomberg used U.S. government data on worker compensation by industry. The average ratio for the S&P 500 companies is up from 170 in 2009, when the financial crisis reduced many compensation packages. Estimates by academics and trade-union groups put the number at 20-to-1 in the 1950s, rising to 42-to-1 in 1980 and 120-to-1 by 2000.

“When CEOs switched from asking the question of ‘how much is enough’ to ‘how much can I get,’ investor capital and executive talent started scrapping like hyenas for every morsel,” said Roger Martin, dean of the University of Toronto’s Rotman School of Management, in an interview. “It’s not that either hates labor, or wants to crush their lives. They just don’t care.”

Johnson’s Multiple

J.C. Penney’s Johnson, who was replaced on April 8 after less than 18 months on the job, had the highest pay multiple, based on $53.3 million in compensation reported in the company’s 2012 proxy. The former retailing executive at Apple took the top job after agreeing to walk away from unvested Apple shares valued at about $80 million.

“The money I earned at Penney’s in 2012 was entirely to replace money earned at Apple,” Johnson said in a telephone interview. “If Penney’s had waited until April 2012, they wouldn’t have had to pay me a penny. The board wanted me to start sooner.”

Comparing his earnings to the $29,688 average compensation for a department store worker is the equivalent of stacking the length of a loaf of bread — give or take a few slices — against the height of the Empire State Building.

Johnson, who says he resigned, was replaced on April 8 after less than 18 months on the job. Six days earlier, the Plano, Texas-based chain filed its 2013 proxy reporting his most recent annual compensation as $1.9 million, with no bonus, stock, options or incentive pay. The company declined to comment, said Joey Thomas, a spokesman.

Worsening Morale

Pay-ratio supporters, led by activist investors and trade unions including the AFL-CIO and the $52.4 billion United Auto Workers Retiree Medical Benefits Trust, say mandatory disclosure would help inform shareholders on advisory say-on-pay votes at companies’ annual meetings.

“Executive pay at some companies is excessive and leads to a number of risks, in particular the risk of damage to the company’s social license to operate and the risk of worsening employee morale,” said Tim Macready, chief investment officer of the Christian Super pension fund in Australia, which has about $700 million under management. The pay ratio is a “useful metric in identifying and dealing with both of these risks.”

Abercrombie & Fitch, the clothing retailer, and Simon Property Group, the real estate investment trust that owns and manages shopping malls, had the second- and third-highest ratios. Ninety percent or more of the CEO compensation at each company was in stock or option awards that vest over time — in Simon’s case, eight years — yet are required to be reported in the year granted. If such multiyear awards were reported in the years they vested, the ratios would drop.

Say-on-Pay Votes

Both companies lost say-on-pay votes last year, getting 24 percent and 26 percent of voting shareholders’ support respectively, according to proxy solicitor Georgeson. Typically, more than 90 percent of voting shareholders back the non-binding resolutions at S&P 500 corporations.

Abercrombie CEO Michael Jeffries got $48.1 million, according to the New Albany, Ohio-based company’s 2012 proxy. That’s 1,640 times the average clothing-store worker’s $29,310 in pay and benefits. Jeffries’s stock-appreciation rights — valued at $43.2 million in the proxy — had no realizable value as of April 25 because the share price fell.

His next compensation report won’t include any equity awards and “will be a fraction of the number reported in 2012,” Phil Denning, a company spokesman, said in an e-mail.

At No. 3, Simon Property Group, CEO David Simon’s $137.2 million in compensation for 2011 was 1,594 times the average pay of $86,033 among employees of funds, trusts and other financial vehicles.

Method Criticized

Investors thought the package “too large,” according to the company’s April 4 proxy. In response, the CEO and the board compensation committee reduced the amounts he qualified for in the early and final years of the eight-year agreement. The committee also tied annual incentive awards more closely to a performance measure called funds from operations and created a peer group of companies for comparing results.

Simon Property’s latest proxy, filed after the cutoff for Bloomberg’s analysis, reported the CEO’s 2012 compensation at $17.2 million, which would have reduced his pay ratio to about 168.

Hugh Burns, a spokesman for the Indianapolis-based company, criticized Bloomberg’s analysis as outdated. It “creates a completely misleading result that grossly overstates and inaccurately portrays David Simon’s compensation and makes any comparison meaningless,” he said.

Dodd-Frank Differences

Bloomberg’s ratio is based on the SEC-required summary compensation table that companies publish in their shareholder proxy statements. It includes the CEO’s salary, bonus, perks, changes in pension accruals and the current value of stock-based awards made in the disclosure year.

The ratio differs from what Dodd-Frank requires in at least two respects: It’s drawn from government pay-and-benefits data aggregated by industry instead of from each company’s actual payroll; and it compares CEO pay to the average for all non- supervisory employees in the U.S. The law calls for the ratio to be based on the median of all employees worldwide, including managers and executives other than the CEO.

Bloomberg’s method is similar to one the Center on Executive Compensation suggested as an alternative to Dodd- Frank’s in a Nov. 11, 2011, letter to the SEC.

U.S. Senator Robert Menendez, the New Jersey Democrat who authored Dodd-Frank’s pay-ratio requirement, heard little objection when he proposed it in March 2010, said Michael Passante, a former legislative aide -- “except for one group,” the center.

Five Meetings

Since then, HR Policy Association representatives have conferred with SEC officials on the pay-ratio rule at least five times and the center has addressed at least four letters to the agency opposing it, the regulators’ records show.

The non-profit group shares offices and staff with the Washington law firm of McGuiness & Yager, which lobbies Congress and federal agencies on compensation and benefits issues. Senior partner Jeffrey McGuiness is listed as the association’s CEO. Bartl, at the compensation center, is a partner in the firm.

McGuiness didn’t respond to requests for comment. Bartl declined to answer questions after an initial interview.

HR Policy took in $7.2 million from members and conferences in 2011 and turned over $1.2 million to the compensation center, according to its 2011 tax filing.

McDonald’s Chair

Richard Floersch, chief human resources officer of Oak Brook, Illinois-based McDonald’s, has chaired the board committee that oversees the executive-compensation center, according to an entry that appeared on HR Policy’s website earlier this month. It has since been deleted.

Former McDonald’s CEO James Skinner, who retired in June, was No. 66 on the Bloomberg list with a CEO-to-worker pay ratio of 351 in 2011.

“We’re proud that more than 40 percent of McDonald’s leadership, including three former CEOs, started their careers working in our restaurants,” said McDonald’s spokeswoman Rebecca Hary in an e-mail.

Honeywell International, No. 16 on Bloomberg’s list with a ratio of 633, joined HR Policy’s board this year. The association “discusses a wide variety of topics, not all of which Honeywell supports and not all of which are relevant to Honeywell,” said spokesman Rob Ferris in an e-mail.

The SEC, which has so far written 39 of 94 rules called for under Dodd-Frank, has no deadline for completing the pay-ratio provision. In February, Commissioner Luis Aguilar suggested that companies voluntarily disclose their ratios until the agency can develop its rule.

Repeal Sought

“Companies that can justify the amount that they are paying their CEOs and employees shouldn’t be fearful of the ratio,” Aguilar, a Democrat, said in an interview. Bartl, at the compensation center, responded with a letter asking Aguilar to “retract” his statement.

SEC Chairman Mary Jo White, who took office this month, and the three other commissioners declined to comment.

U.S. Representative Bill Huizenga, a Michigan Republican, is sponsoring legislation to repeal the pay-ratio requirement. It “doesn’t do anything other than play politics,” he said in an interview. “It doesn’t lend any useful, helpful, analytical type of information.”

The bill reprises one filed in March 2011 by former Representative Nan Hayworth, a New York Republican, who lost re- election last year. Political action committees associated with companies on the HR Policy board gave $78,416 to Hayworth’s 2012 campaign. Her contributions from the same companies totaled $22,000 in the 2010 cycle, Federal Election Commission records show. She didn’t respond to a request for comment.

Registered Lobbyists

Seven companies with pay ratios in the top 20 percent of all S&P 500 corporations registered to lobby on the measure: Tyco International, GE, Johnson Controls Inc., Prudential Financial, McDonalds, AT&T and Lowe’s. Each was also represented on HR Policy’s board last year. Except for McDonald’s, none responded to requests for comment.

Pay-disclosure rules have been controversial since the Securities Exchange Act of 1934 imposed requirements for regular reporting of executives’ compensation on public companies.

The rank and file were sure to seethe with discontent, wrote National Biscuit Co., later Nabisco, in a 1936 petition to the SEC. Only “criminal curiosity” underlies such interest, wrote Congoleum-Nairn Inc., a manufacturer of linoleum flooring. The comments are cited in a history of the era’s corporate-pay debates by Harwell Wells, an associate law professor at Temple University in Philadelphia.

Suggestion Rejected

James Cotton, a retired securities attorney for IBM, may have been the first to propose mandatory disclosure of the CEO pay ratio. He said it would have “a significant impact by either lowering the excessive executives’ compensation or raising the average compensation of employees and managers” in a 1997 article in the Northern Illinois University Law Review. He got the idea shortly after joining IBM in 1970, Cotton said in an interview.

The young attorney, an Army captain during the Vietnam War, said he was listening to managers discuss how to handle the company’s cash when he proposed giving out raises.

“They looked at me like there was something wrong with me,” Cotton recounted. “They said, ‘We can’t do that.’” For years after that, he said, he kept an eye on the CEO’s pay and IBM’s cash holdings, both of which increased.

Informing Workers

Cotton said he mailed his law review paper to the SEC, members of Congress and some unions, including the AFL-CIO, and then forgot about it. Now retired at 73 and almost blind from glaucoma, he didn’t know until recently that the ratio’s disclosure was included in the Dodd-Frank Act.

The ratios will help inform workers, he said. “‘Am I going to get ripped off? Or am I going to get a fair price for my labor?’ If there’s anything I want to happen, it’s that.”

Nowhere was the pay multiple higher last year than at J.C. Penney, where Rebecca Gonzales made $13,797.15 at a store in Tulsa, Oklahoma, according to her 2011 wage and tax statement.

One month after Johnson joined the company as CEO, during the December 2011 holiday rush, Gonzales fell over a box of hangers at work, and said she couldn’t immediately stand up.

“All I remember is seeing black,” she said.

A doctor at an urgent care clinic ordered her to stay off her swollen knee, she said. When she returned to work, she ran a cash register from a chair until a manager took the seat away, she said. Unable to work, she filed a claim for temporary disability benefits in state Workers’ Compensation Court in February 2012. She’s the sole wage earner for her disabled husband and two school-age children.

Thank-You Note

A month later, the company warned she’d lose her job if she didn’t return within 30 days, according to a letter she received. Two weeks later, it wrote again.

“Your employment with J.C. Penney has been terminated,” the letter stated. “Thank you for joining the J.C. Penney team!”

A judge ordered the company to pay Gonzales $1,516 for the temporary total disability. She filed a wrongful-termination claim in federal court seeking at least $75,000 more. That suit is pending.

Hers was one of 43,000 jobs the company cut last year as Johnson’s retailing strategy failed to take hold. The share price fell by half between the time he took the CEO post and left it.

In January 2012, Johnson sold almost half the 1,660,578 shares he’d been granted, for $32.2 million. He still owned almost 893,000 shares, with warrants on 7.3 million more, as of J.C. Penney’s April 2 proxy. He made the sales “entirely to pay taxes,” Johnson said.

Top Six

In all, the company awarded six top executives $190 million for the fiscal year that ended in January 2012, according to its proxy. All subsequently left the company.

Johnson’s predecessor, Myron E. Ullman — who received $34.6 million in pay and retirement benefits in his final year — got $1 million to come back, a recent filing shows.

“The irony of the CEO pay ratio is that most people’s experience of J.C. Penney will be the people who are paid the least, and treated most like commodities,” said Harvard Business School professor Rakesh Khurana.

For now, Johnson and Gonzales are unemployed. The former cashier says she’s looking for work.

Originally published by Bloomberg.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments