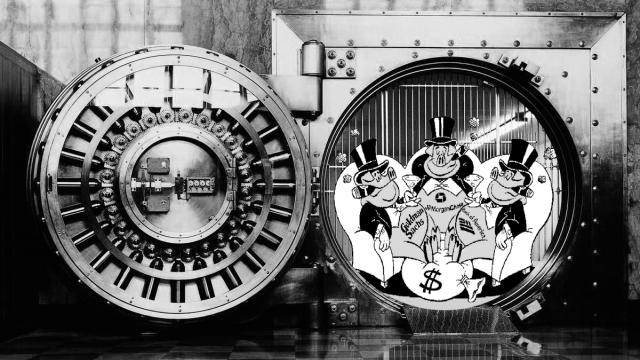

They just can’t help themselves. Like the drunk that ruins family holiday gatherings year after year, the big banks, once they are caught in yet another episode of their serial criminality, feign contrition, pay billions in fines, and swear to go forth and sin no more.

But these repeat offenders know the law does not apply to them. These 21st century pirates of the Caribbean were actually rewarded for sacking and pillaging America. They never have had a greater share of the pie and they have no allegiance other than global wealth accumulation beyond the reach of any social contract.

The one relationship to which they remain faithful is the fee for service one they have with the members of Congress they showered more than $65 million in campaign donations on since 2012.

You would have thought after they peddled hundreds of billions of dollars in worthless toxic mortgage-backed securities to the nation’s pension funds, setting into motion the largest destruction of American household wealth since the Great Depression, the big banks would have taken their bailout and tried to stay out of the headlines.

But in the years since they took the U.S. economy for a near death spiral spin they have been caught instigating one scam after another. No sooner had the big banks settled with the federal government for perpetrating their massive mortgage fraud and they were back pushing the envelope. Law enforcement and regulatory agencies all scrambled to keep up with these banking behemoths that navigate the line between innovation and criminality with the help of former regulators and prosecutors in their employ.

Though it has not been that long since the last financial collapse, their list of alleged transgressions is long: fixing international interest rate benchmarks, rigging the foreign currency exchange market, squeezing consumers and other sectors of the economy by manipulating the prices of basic commodities like aluminum and copper by staging scarcity.

Meanwhile, in just the last three years the biggest investment banks pocketed close to a billion dollars in fees by structuring so-called inversion deals that help U.S.-based companies make more money by shifting their address out of the country to reduce their U.S. tax obligations. How else to force the public sector on the required tax revenue diet so as to be able to invoke a faux scarcity that can bring public unions to their knees and force the slashing of entitlements?

Despite all the post-2008 fiscal crisis hand-wringing, the biggest banks have gotten only bigger. In the shadows still lurks the systemic risk of another meltdown if just one of them does a Lehman.

Last month the Federal Reserve’s Office of the Inspector General took the Federal Reserve to task for failing to properly oversee JPMorgan, whose beached London Whale caused the bank to loose $6 billion — even by JPMorgan standards a bad day at the office.

Even after the financial collapse, and with all of the collateral damage still evident, the Federal Reserve appears enamored of the industry it regulates. As Sens. Elizabeth Warren and Joe Manchin wrote in a Wall Street Journal Op-Ed earlier this month, it often seems the regulators are “more worried about protecting Wall Street than protecting Main Street.”

Back in a September edition of “This American Life,” Carmen Segarra, a former Federal Reserve Bank examiner and whistle-blower, pulled back the curtain on the Federal Reserve. Her secretly recorded tapes illustrated how the Federal Reserve remains “captive” to banks like Goldman Sachs where Segarra was embedded.

It’s easy to understand how the Fed and the banking industry are so closely cross-pollinated. Just look at the résumés of the key players. Consider that the New York Federal Reserve is presided over by William Dudley, who worked for Goldman Sachs as its chief economist for a decade. There’s no big money in being a career regulator.

In public comments Dudley insists the New York Fed has learned the lessons from the 2008 meltdown and has the banking industry under heightened scrutiny. Dudley says compelling banks to undergo so-called stress tests has made the entire industry safer and sounder.

Yet just this past summer the Federal Deposit Insurance Corp. and the Federal Reserve itself warned the 11 biggest banks – Bank of America, Bank of New York Mellon, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street Corp. and UBS – that their plans for a potential bankruptcy were wholly inadequate and offered no road map for avoiding a repeat of the 2008 meltdown. What have these people been doing?

The good news is that we have a choice. There are other models out there for banking. We need to bet on institutions that bet on us and our communities.

Consider the Bank of North Dakota, an actual state-owned bank that was formed in 1919 after the progressive Non-Partisan League made a clean electoral sweep capturing both the governor’s mansion and the state Legislature. Former socialist organizer A.C. Townley tapped into deep resentment of out-of-state big business interests whose speculation threatened to undermine the community- based self-reliance that North Dakota farmers were rooted in.

According to an analysis done of the Bank of North Dakota by the New England Public Policy Center back in May 2011, a majority of the state bank’s deposits are from tax collections and state fees. Last year the only state bank in the nation reported out its ninth year of record profits with a total asset base of $6.1 billion. The state got a 17.6 percent rate of return on its investment.

Historically the bank has been able to help the state close budget shortfalls as it did in 2001-2003 with a $25 million dollar cash infusion into the state’s general fund. Over the last decade it has plowed $300 million back into the state.

“BND’s loan performance and capitalization remained robust even during the recent financial crisis and recession,” the Policy Center reported. Most important, its profit goes to sustaining the communities from where their deposits come from.

The bank provides affordable student loans, backs economic development and finances housing construction. It gets cash relief to parts of the state hit by natural disasters faster than Uncle Sam can. It runs with just 180 employees.

According to the Public Banking Institute, the first such public bank was established by the Quakers in Pennsylvania when it was still a colony. Today, around the world in such bulwarks of capitalism as Australia, Canada and Germany, these institutions exist alongside the conventional commercial banking sectors giving consumers and communities a meaningful choice.

Throughout the U.S. millions of consumers have turned to local credit unions, which are nonprofit financial cooperatives that are transparent and rooted in the communities they serve.

Perhaps the time has come for local, county and state governments to send a message to the big banks that the politicians and regulators have failed to deliver. While forming a state bank is a pretty heavy lift, maybe it’s time for governments to place their overnight deposits with institutions like credit unions.

After all, isn’t free-market capitalism all about choices?

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments