Welcome! Step right up – pull the handle, blow on the dice and have a drink on us... or better yet a Dum Dum lollipop on your way to homelessness.

Recent discoveries have unveiled even more scandal, fraud and deceit from the wild wild ways of Wells Fargo bank. It appears that the runaway rip-off has grown from over 2 million bogus accounts created by Wells Fargo’s team to more than 3.5 million. Oops... stay tuned though, as more is unfolding.

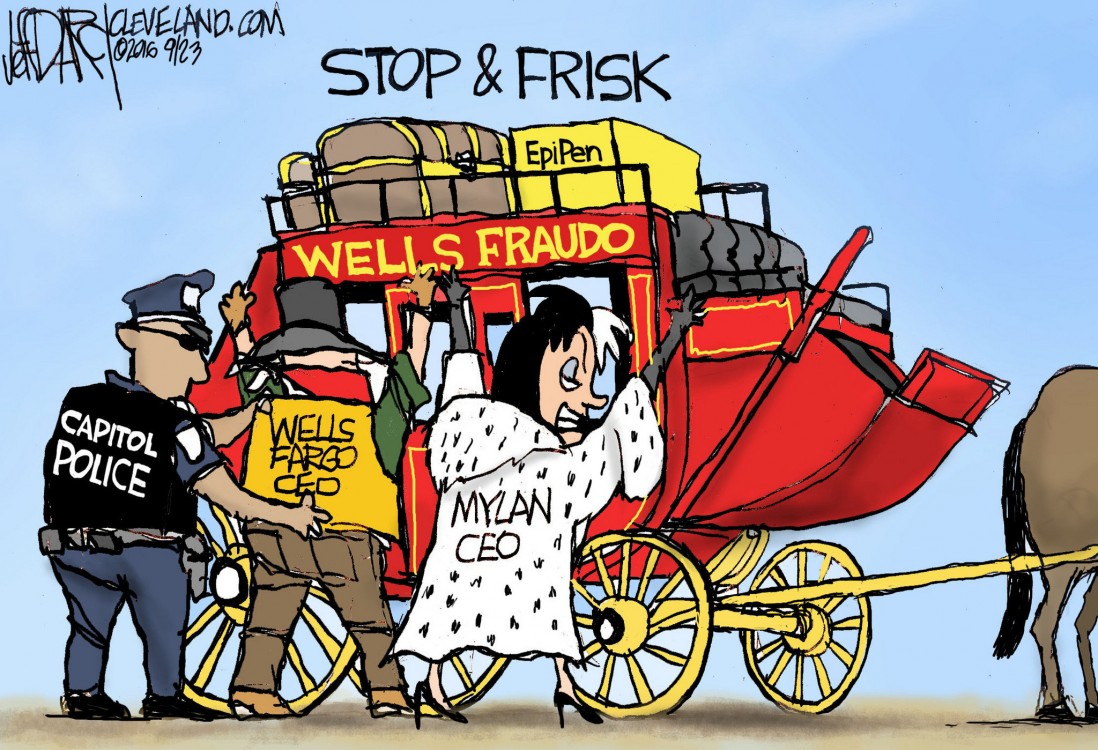

The fact is, these days Wells Fargo is hemorrhaging scandal. Perhaps they should change the name to “Wells Fraudo Bank: Scandals Are Us,” since it seems these patterns have been a regular business standard for them since before 2002. “Together we’ll go far.” But no one realized just how far.

It’s especially difficult for those passengers on the runaway stagecoach to bail, tuck and roll if they’ve got a mortgage with this bank. You may have bought the ticket for 30 years. That is a long ride of “Are we there yet?” Not to mention the surprises millions of struggling consumers have discovered along the way.

The world economy has been on a LONG and rugged road since the Wall Street banks toppled the global economy due to their gambling addiction and Bernie Madoff ways on a giant scale. Pull the handle, cross yourself and fill out these documents to make your ridiculous rate affordable. Here, suck on this. Consider it a pacifier as we rob you of your troubled assets. "Does this bail out make my assets look big?”

Before the crash these banks made buying a house the season’s must-have accessory with the Rockwellesque imagery of green lawns, family gatherings and the promise of a rose garden. After 9/11, Bush urged people to go shopping. Just act natural. Everybody qualifies for zero down and stated income... Countrywide. Welcome home.

But they all got a little greedy. Couldn’t tell after a while if it was day or night. Roll the dice, close those deals, shake that hand. Hit me. With a buzz that good, they just couldn’t quit serving up the American dream to anyone and everyone that would sign their name on the dotted line. They even went to churches and low income neighborhoods with incentivized options. Peace be with you. Sign here.

What’s a little predatory lending between friends? You need this.

Wells Fargo patterns are the very same in the mortgage servicing division as they are in the criminal accounting division: either way the consumer is screwed because this bank is a criminogenic systemically fraudulent machine: incentivized harm at all costs for the almighty dollar. Their mortgage servicing issues are epic compared to what's been exposed by the 3.5 million bogus accounts, fraud, identity theft, forgery, predatory lending, harm to credit and more. It's the same protocol with Bank of America, Citi, Chase, Deutsche, US Bank, Nationstar, Ocwen, etc.

If one didn't know better, you'd think the CEOs of the world’s largest financial institutions had all met in an undisclosed location to coauthor the fraud manual we can view online.

President Obama put the Home Affordable Modification Program (HAMP) into play to help struggling homeowners adjust their mortgages to an affordable fixed rate after Wall Street banks toppled the world economy, inflated the mortgage market, inflated appraisals, and created “liars loans.” But then these banks bastardized that program to further enrich themselves, incentivizing their system and employees to fraudulently move homeowners to the foreclosure track rather than the intended assistance outlined in the Special Inspector General for the Troubled Asset Relief Program (SIGTARP) agreement.

They were even paid to follow the program with the TARP bank-assisted bailouts but instead these same banks used the government assistance program to further stuff their pockets and spit out consumers labeling them as “deadbeat borrowers” – much as the Wells Fargo executives and CEO placed the blame on over 5,300 lower level employees for the accounting scandal. CEO John Stumpf even coined the phrase “Eight is great” as a selling mantra and corporate motto to apply impossible sales quotas on bank employees to open these accounts or lose their jobs.

Numerous articles and media attention have illustrated how far those employees were willing to go in order to meet Wells Fargo's impossible demands. It’s been reported that Wells Fargo employees were opening accounts by actually signing up people who were looking for work in the Home Depot parking lot, coercing family and friends to sign up for multiple accounts, forging signatures, and predatory practices on seniors and minorities.

Now imagine the level of fraud as it relates to the mortgage crisis and foreclosure practices carried out by the Wall Street banks, and Wells Fargo in particular, which were wiling to engage in criminal patterns for far less monetary gain. Perpetual “loss” of documents, wrongful denials for assistance, securitization fraud, forged signatures (as in the "60 Minutes" reports of using temps to sign the name “Linda Green” to fast track consumers into foreclosure) inflating appraisals, collecting default insurance after instructing homeowners to default on their mortgage, and on and on. We're talking about billions of dollars that were gained since 2007-08, and are still being gained via short sales, new loans, foreclosures and falsified land recordations.

An article from 2008 in American Progress clearly spells out the government’s approach to the above: “Treasury Secretary 'Hank' Paulson yesterday made it absolutely clear that he had no intention of using the authority granted to him by Congress under the $700 billion Troubled Asset Relief Program, or TARP, to purchase troubled mort-gage-related assets or to provide relief to struggling homeowners facing foreclosures. The message was clear to homeowners facing foreclosure and their neighbors watching the value of their homes plummet—drop dead.”

The government and media alike would love to move on from all of this and start over, as it reflected extremely poorly on both of them. In terms of where to go from here, there's not much time for an administration papering the White House walls with Goldman Sachs suits to actually implement any assistance for struggling consumers, let alone bank regulations which are obviously not in the interest of those in charge. The ripples of the housing crisis continue to reverberate in all aspects of consumerism, whereas if the banks had instead applied the assets given to them by our tax dollars to make adjustments that leveled the carnage, we wouldn’t still be in this ongoing crisis.

But let's face it: The air is being sucked out of the room by the monied class to further its agenda, enrichment and preservation. Yet if the underclasses, ie. the majority of humanity, cannot support themselves, afford shelter, survive or thrive, there will be catastrophic hell to pay. Instinct tells us to fight for our lives, and that is what we are coming to as a democracy on every level. If there is no respect for justice, fairness or integrity in our financial system or governance, there will be a reaction of civil unrest, more violence, civil disobedience and utter chaos. Time to buy stock in cat food. Time to make humanity a valued commodity. Time to bank on more than hope. Time to hold those that deceive, cheat and sabotage to the same standard the rest of us are held. Onward we march.

And remember, don’t blow the nest egg. Don’t take candy from strangers. Don’t bank with felons. Put your money where the Dum Dum suckers go – into a community bank or credit union. Our only power as consumers are the choices we make in our spending to send the message we want loud and clear: to use that energy, our own financial currency in keeping with our own values and integrity. Why continue to play at the table where the cards are marked and the dealer is a cheat? There’s a very active group on Facebook called “Wells Fargo Sucks!!!” Ironic, isn’t it, that Wells Fargo gives out free Dum Dum suckers? You are what you eat. Subliminal sugar coated fraud... you’re welcome.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments