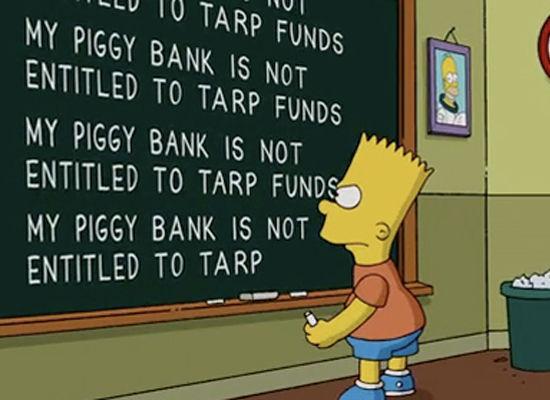

A Missouri bank executive who used nearly $400,000 in taxpayer-provided bailout funds to buy himself a luxury condo on Florida’s Gulf Coast pleaded guilty to charges of misleading investigators about the purchase in federal court on Tuesday. The maximum penalty Darryl Layne Woods faces is one year in prison and a fine of $100,000, according to the Justice Department.

Woods ran Mainstreet Bank in Ashland, Missouri, as well as the company that owned Mainstreet. That holding company, Calvert Financial Corporation, received $1 million from the Troubled Asset Relief Program (TARP) in January 2009. Woods spent $381,487 of that money to buy a luxury condo in Fort Myers, Florida, a few days later.

While the $700 billion financial industry bailout helped Woods buy a house, it hasn’t helped millions of struggling homeowners. TARP was supposed to pass $46 million to homeowners, but three years into the program just 10 percent of those funds had actually reached borrowers.

The primary program by which TARP dollars were supposed to aid homeowners – the Home Affordable Modification Program or HAMP – hasn’t just failed to reach anywhere near as many struggling borrowers as advertised. It’s also failed to provide sustainable help to the few it has reached. Half of the loans modified under HAMP are back in default.

In addition to the government’s failure to provide any meaningful form of bailout to main street, its efforts at enlisting big banks in a fight to stem the foreclosure crisis have been riddled with problems.

A settlement with five of the largest mortgage servicers produced very little direct aid to homeowners, many of whom didn’t even bother cashing the tiny checks mailed to them under the National Mortgage Settlement. Furthermore, banks have continuously violated the termsof the settlement, and consumers around the country continue to face abusive mortgage servicing and foreclosure practices.

The government stymied an independent foreclosure review that had found evidence of millions of wrongful foreclosures nationwide, saying the information about industry practices constituted “trade secrets” that couldn’t be revealed.

In Woods’s would-be home of Ft. Myers, the foreclosure rate remains among the highest of any metropolitan area in the country. Florida had the highest foreclosure rate of any state in the first half of 2013, with one in 58 homes in foreclosure.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments