Let’s say your local government repeals the speed limits, prompting a rise in accidents that culminates in a horrific pile-up with multiple fatalities. The town reinstates the limits, remembering the hard way why they were imposed in the first place. Big trucking companies find that this impedes business, but calling for yet another regulatory repeal would be bad optics. A better approach: a piecemeal, gradual dismantling that’s unlikely to provoke strong objections.

Something like that seems to be going on with financial regulations put in place as a response to the 2008-09 financial crisis. I noted some of them here. The latest front in the war against prudential regulation involves the Volcker rule, a provision of the 2010 Dodd-Frank act which placed constraints on activities of large financial institutions that put everyone at risk.

Federal regulators are proposing amendments that would make it easier for large banks to comply with the rule and to define what constitutes proprietary trading. They are not totally dismantling the rule, but in revising it they are pushing financial regulation in a direction that should worry everyone.

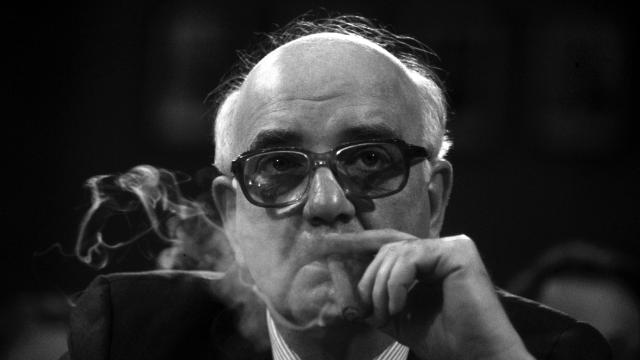

The Volcker Rule, named after former Federal Reserve Chairman Paul Volcker, restricts so-called proprietary trading by commercial banks (as opposed to specialized institutions like hedge funds, which are built for risk-taking). These are speculative, high-risk trades meant for the bank’s own benefit, not that of its customers.

One rationale for the rule is that banks should be not be able to make risky bets that are in effect underwritten by federal deposit insurance, which is backed by a line of credit with the Treasury that can run up to $500 billion. Banks have pushed back against the Volcker Rule since the day it was proposed, but it’s prudent to be skeptical of their arguments, if only because they have an obvious vested interest in being free of regulation. It’s not obvious what vested interest Volcker Rule defenders have.

Corporate lobbies are good at making elitist, self-serving arguments sound like populist causes. Banks are forever straining against regulation so that they can bolster lending, “serve” markets and “create jobs.” But a bank CEO has no obligation to the work force; his only obligation is to his shareholders, and if market fundamentalists are to be taken at face value, that’s all he should be concerned with. The jobs argument is just a fig leaf covering naked self interest.

Another bank argument is that the Volcker Rule is too complex and poses an unreasonably heavy compliance burden. Maybe, but it was the banking industry’s swarming lobbyists that made it so, demanding exemptions and other tweaks that turned what was originally a 10-page bill into a 1,000-page law. (See how that works? You create complexity, then complain about it.)

Then there’s the line that proprietary trading had little or nothing to do with the financial crisis. That’s a verbal sleight-of-hand: Trading itself is not the source of risk, but the large holdings that result are. And no one is saying that it was the cause, just one of several. What’s more, there’s good evidence that risky “trading assets” did indeed help fuel the crisis, and that they represented a more significant portion of business than banks let on.

Even if proprietary trading were not a cause, that’s no argument for leaving it unregulated. No one would argue that since passenger cars cause most accidents, speed limits shouldn’t apply to trucks. Any speculative activity by large, well-connected banks is a potential source of systemic risk.

One worrying aspect of the proposed amendments is that they would saddle regulators, no longer the banks, with the burden of proving improper trading. The problem here is that resource-rich private banks are always three steps ahead of hampered regulators in finding ways around regulation, no matter how strict. Wall Street lawyers “are smart as hell,” former Delaware Senator Ted Kaufman, a Democrat, told the Times a few years after his own, harsher proposal for the Volcker rule failed. “You give them the smallest hole, and they’ll run through it.”

Another argument is that the Volcker rule has suppressed liquidity – the ease with which assets can be traded, an important component of smoothly functioning financial markets. But a 2017 report by the Securities and Exchange Commission found that liquidity has actually improved under Volcker.

Even if Volcker has marginally impeded efficiency, it’s not clear how that cost outweighs that of the systemic risk that Volcker seeks to contain. The test of good policy is whether it produces a net social good, not whether it optimizes market efficiency. As the eminent economist Paul Samuelson once put it, “every good cause is worth some inefficiency.”

It’s not easy to see large, tectonic shifts in policy while they’re happening, so they happen beneath most people’s radar. But what’s transpiring here is yet another effort by Wall Street to make folks forget why regulation was needed in the first place, and because the effort is incremental the threat is seldom obvious – until, of course, off-the-leash financial institutions burn down the house again.

Follow the author on Twitter @CgayNYC